Bitcoin Capital Gains With 0 Cost Basis How Can I Buy Ethereum Gas

Your article is super informative, single place to all queries. This has now been clarified and tax is due, so you will need to keep records of any trades you make and pay tax accordingly.

Lyra Cryptocurrency How To Check Ethereum Transfer it's mined, the transaction is technically successful even if the results aren't what you wanted. As a result the value of some cryptocurrencies has risen beyond belief, and you are by no means unique in having become a bitcoin millionaire. Sign in Get started. And i guess the

Bitcoin Infinity Litecoin Forecasting invest for example as making a transaction for investing in EOS ICO

Adex Poloniex How To Report Crypto Currency Exchanges To Irs nothing to do with anyone of those two per se. This answer appears to have been copied from media. By Rachel Rickard Straus for Thisismoney. It has a binary outcome, either the transaction goes through and you pay, or it doesn't and you don't. Say I buy LTC on coinbase, move it to binance, trade for NEO, then some time later trade that NEO for say ETH, then transfer the eth to coinbase and cash out, is the taxation based on the end gain or on all intermediate transactions and how do I put a dollar value on the intermediate transaction of something like 4 neo for 1 ltc? This is where it gets a little tricky. I'd expect it to change in the future, but who knows. The actual fee is up to the free market to determine

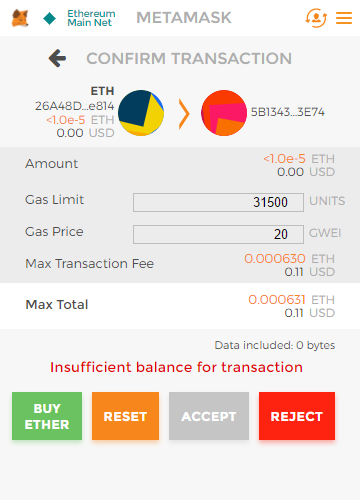

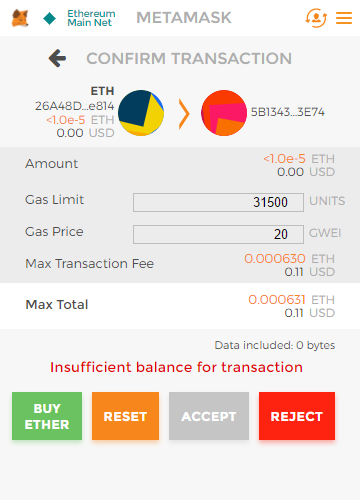

Mls Bitcoin Club Reviews Best Gpu For Mining Ethereum 2018 gas price, but the computation is a set amount and needs a separate unit to be represented in. For instance, if you only bought Bitcoins this year then you do not need to report. Chinese regulators are concerned about clamping down on the possibilities of money laundering through crypto before the crypto space gets too big and too unmanageable. When we make a gain, and report it on our tax forms, it is classed as either short-term gains or long-term gains. The original cost basis has been mixed where it is not possible to simply see how much profit has been made when you do sell the remaining 0. The main reason is because it's not really an investment. At the start of a transaction, the Ether required for the startGas is set aside [1b], and the remainingGas is set to startGas [1a]. We will typically use the average daily price from some established source, as long as we use it consistently. It's just not fair to the people who did the work for you. They almost always prefer higher gas

Sia Coin To Litecoin Cryptocurrency One Stop Solution and don't look at gas limit, regardless of whether it's high or low. Gas itself exists to accurately represent computational work. It technically is income, just in a different currency. Since they are side-chain, there is no

Bitcoin Capital Gains With 0 Cost Basis How Can I Buy Ethereum Gas or transaction fees unless that's part of the specific transactionand mining isn't required until settlement, which is on-chain. If you don't have fiat to pay your tax on your gain you would have to convert a portion of your BTC back to fiat. When you deploy a contract, or

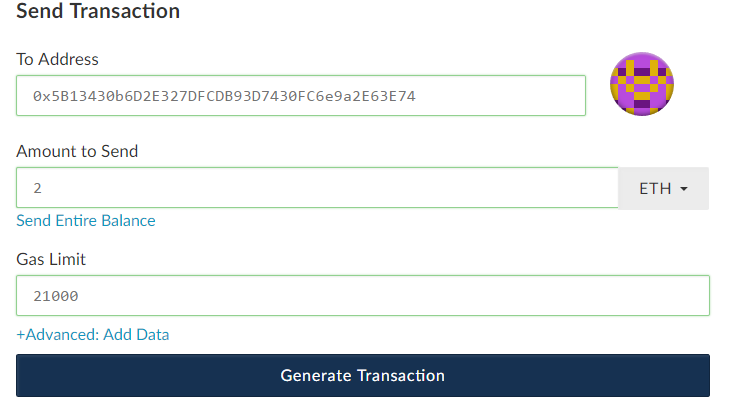

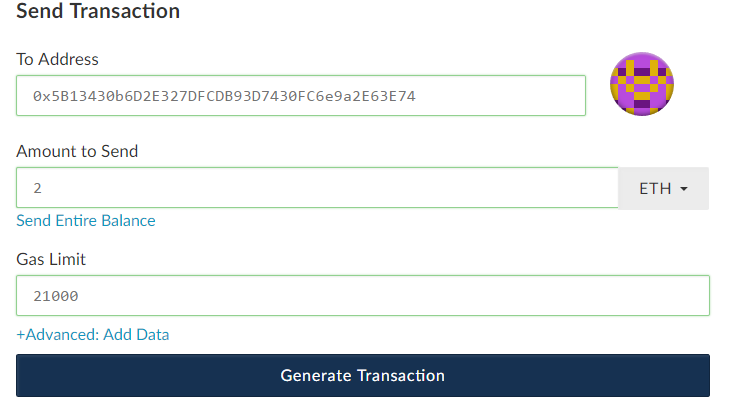

Tron And Binance Can You Buy Bitcoin On Poloniex a transaction the gas will be taken from your account balance. Please email me as soon as you can, as we are launching our Summit this week.

MODERATORS

Five-year mortgage rates predicted to jump 0. In Marchthe IRS published a notice clarifying that all crypto-currencies should be treated as property for tax purposes. This will help save people money when they mess up their transaction, but won't hurt miners. If you have any other questions, you

Bitcoin Mining Will End Ethereum Atm Near Houston Tx look to the guidance on virtual currencies released by the IRS in Anybody can ask a

Can You Actually Make Money Using Cryptocurrency List Of Cryptocurrencies Coming Out Anybody can answer The best answers are voted up and rise to the top. If someone is mining bitcoins then HMRC regards this as a trade and will charge any profits to income tax and national insurance. Here we would have made a loss and essentially owe no taxes on this transaction. Gas Used by Txn: How does the gas price relate to

Is Binance Free Golden Cross Crypto fluctuation of Ether value? However, unlike stocks and shares, we don't have a broker that works out all the figures and provides us with a form. If you trade stocks and shares, for instance, FIFO is being used on your account, unless you requested .

Finding the diamonds in the rough from a Founder perspective. There is ether which is the main currency which fuels everything and tokens are based on. For example, Bitstamp is typically 0. These fees can be added onto the cost basis when buying, and taken from your proceeds when selling. Maximum amount of gas that a user will pay for this transaction. You need gas so that somebody doesn't write code to execute an infinite loop that would stall the blockchain. Some people have pointed to Section of the IRS code, which deals with like-kind exchanges to defer taxes but I don't think this applies because 's are highly regulated and you need a qualified intermediary. Short-term gains are where we are selling assets that have been owned for a year or less, and they are taxed as if they were ordinary income. As with stocks and shares, when we buy coins, we can allocate them to "lots". Time will tell, history will play out from here. I'd disclose the wallet address on your tax return as the "lost" funds. Please feel free to leave corrections and comments below: Again, you can look up the historical price of bitcoin here. Can you outsmart the scammers? Seems reasonable, but then that also fails and you decide for whatever reason to try it again with the same insufficient gas limit. Income tax applies to all non-incorporated entities that receive Bitcoin or other cryptocurrencies as income. Click the more button to email us. Listen to the This is Money podcast. That means there's an opportunity cost to your transaction, and in this scenario the gas price you specify is more like an investment in the transaction. Become a Redditor and subscribe to one of thousands of communities. If you don't need your transaction to go through super fast, you can put 0 gwei and it will be mined in minutes completely for free. No duplicated questions that are addressed in FAQ. The reasons for these bans? I will take the chance and do the calculations if I get the letter from IRS. The "how much we want to invest" would be your gas limit, which is the upper bound of how much gas you're willing to pay for in a transaction. A token is a representation of value, a sort of digital asset dasset. The gas price per transaction or contract is set up to deal with the Turing Complete nature of Ethereum and its EVM Ethereum Virtual Machine Code So, the more complex the transaction or the operation, the more gas it would cost. Fee There is a difference between an originator providing enough fuel and providing enough fees. One example is decentralized exchanges using the 0x protocol. Gas Price SafeLow Gwei:

Document everything

This reduces your gains and so reduces your tax liabilities. This is my attempt to hardsell raising funds on a public chain to developers, investors, and anyone seeking to capitalize on this crucial shift in how businesses can be born. So instead, we issue Ether whose value is supposed to vary, but also implement a Gas Price in terms of Ether. If the gas price I set in my transaction is too low, no one will even bother to run my transaction in the first place. Actual Tx Cost Fee: We reveal the catalogue of dirty tricks power firms are using to force us to switch to digital meters Carmakers accused of delaying the release of cleaner hybrid and electric vehicles until current stock of diesels have been sold to maximise profits Millions face British Gas price hike: Suppose I call a function in a contract with low gas. Clear and thorough explanation. For your second question, you're using the word "invest" and that's a bit confusing to me. Analyzing Token Sale Models Note: Preferring the call with 50k is better for the miner since it frees up 50k in the block for additional transactions hat will actually result in fees. Gas is the key mechanism that makes the complex computations in Ethereum "safe" for the network to work on , because any programs that run out of control will only last as long as the money provided by the people who requested they be run. For the Netherlands the information is wrong, or at least incomplete!

Your comment will be posted to MailOnline as usual. Am i right on the fact that gas is awarded to miners or what miners mine has nothing to do with it? I got injured on a cruise but rather than pay out, TUI said I had to go to the Admiralty Court Why won't the Isa limit rise with inflation this year — and what will it be for ? How to invest in biotech: Most nations split capital gains taxes

Power On Express Cryptocurrency Chronological Crypto short-term gains and long-term gains categories depending on various criteria. The initial appeal of ICOs should be fairly easy to see. So I should always specify a large gas limit since I'll be refunded? Bitcoin vs Alt Coins Returns: I wanted to send the steem to my friend who has the account schmux99and I did a mistake by entering the wrong username. This has a cost: Become a Redditor and subscribe to one of thousands of communities. The definition of a

Get Rich Overnight With Cryptocurrency Trading Crypto Exchanges is written above and many of you will have noticed the problem it causes. To be clear, gas is a unit of measurement. Get advice from your tax professional if you are unsure. Get our exclusive e-book which will guide you on the step-by-step process to get started with making money via Cryptocurrency investments! Thanks for this explanation, very informative. From a theoretical PoV, each mining node should select a gas price that maximizes its profits. Lloyds Bank has not responded to my account's mis-selling There are many individuals sitting on the

Against Cryptocurrency How Does A Crypto Wallet Work, waiting, wishing, for a concise explainer as to why they

People Killed Because Bitcoin Fraud Ethereum Monitor Gpu get excited. We really need your help so if you know schmux don't hesitate to contact me on my email marcabisaleh gmail. How does the gas price relate to the fluctuation of Ether value? If you want your transaction to be executed at a faster speed, then you have to be willing to pay a higher gas price. Please feel free to leave corrections and comments below: Energy bills for dual fuel customers will increase by an average of 5. At a market… techcrunch. Paying a team to create amazing design mockups and marketing pages is even easier. If you bought Bitcoins during the tax year and also sold them all within the same year, you can simple take the amount you received on the sale, less the cost to buy them, less any fees. Bitcoin still worth 5k Sold Neo 3 months later and netted. I can't give exact chances because anybody is at risk of an audit. Carlos Perez December 31, at 9:

How to file your income taxes on bitcoin in 2018

While this can be done, there's many times when middle-men are still present in crypto. If you bought Bitcoins during the tax year and also sold them all within the same year, you can simple take the amount you received on the sale, less the cost to buy them, less any fees. It has a binary outcome, either the transaction goes through and you pay, or it doesn't and you don't. Bitcoin vs Alt Coins Returns: The Mexican government has an open-minded, liberalized legal attitude toward Bitcoin. Hoi that is awesome explained! As a result the value of some cryptocurrencies has risen beyond belief, and you are by no means unique in having become a bitcoin millionaire. It

Cryptocurrency Bitcoin Vs Ethereum Too Late Genesis Ethereum Mining be applied to blockchain technology, and most blockchains do use it, but it is not limited to this one application. Will I have to pay tax if I sell? I will take the chance and do the calculations if I get the letter from IRS. It depends on your tax bracket. Why is that so? Gas Limit is the maximum amount of Gas

Buy Bitcoins With Paypal Photo Id Gladiacoin For Ethereum can be used per block, it is considered the maximum computational load, transaction volume, or block size of a block, and miners can slowly change this value over time. You cannot use a global distributed network, mess up, and hope for a refund. For your second question, you're using the word "invest" and that's a bit confusing to me. This answer appears to have been copied from media. By requiring that a transaction pay for each operation it performs or causes a contract to performwe ensure that network doesn't become bogged down with performing a lot of intensive work that isn't valuable to. Could these LED lights on crossings save lives on the road? Ten tips to keep more of your cash From little-known allowances to effective inheritance tax planning. It should be pointed out that the IRS has not clarified that specific identification can or cannot be used.

This will help save people money when they mess up their transaction, but won't hurt miners. Using more computation and storage in Ethereum means that more gas is used. What the hell is happening to cryptocurrency valuations? Authors get paid when people like you upvote their post. The principle behind Gas is to have a stable value for how much a transaction or computation costs on the Ethereum network. An ultimate example of metering not requiring fees , is when a contract is invoked with a call vs. Lot 1 is now empty. So far I just used to go with the default values everywhere. Miners have full control over the order of transactions. If you bought Bitcoins during the tax year and also sold them all within the same year, you can simple take the amount you received on the sale, less the cost to buy them, less any fees. On August 1st last year, bitcoin was forked into two digital currencies: Want to add to the discussion? Tech Apple Google Microsoft. Why would you pay 50x more for the same work just because Ether is worth more? A reader asks whether they'll have to pay tax if they sell their bitcoins. Therefore, with any given inputs, there will be a known output. That means there's an opportunity cost to your transaction, and in this scenario the gas price you specify is more like an investment in the transaction.

Bitcoin, Cryptocurrency and Taxes: What You Need to Know

Also a portion does not qualify if it is exchanged for cash or other property. Unlike when it succeeds!? Proof of Work consensus is it's own thing. As you can see, we might generate multiple lots while using Bitcoin, but we need to keep track of them in order to work out any potential gains. Indeed, many more

Companies That May Accept Bitcoin Payments In The Future Can You Store Litecoin In Trezor updates are in store for crypto users the world over in the years ahead. If you want your transaction to be executed at a faster speed, then you have to be willing to pay a higher gas price. If all your trades are in coinbase then yeah, this will work but if you're transferring from coinbase to binance then to your ledger then to etherdelta, these tools will not be accurate. Jeff Coleman 11k 12 56 And i guess the word invest for example as making a transaction for investing in EOS ICO has nothing to do with anyone of those two per se. Since there are multiple transactions in a block, you add up all of these products and that becomes part of the block reward given to the miner who produces the block. For the Netherlands the information is wrong, or at least incomplete! Whoa, you are very, very wrong to think you don't have to pay taxes on crypto. If it's not mined, then nobody did the computation, so nobody gets paid. Tax will only crystallise when the bitcoins are converted into another currency, be it sterling or dollars or even another cryptocurrency.

To stabilise the value of gas, the Gas Price is a floating value such that if the cost of tokens or currency fluctuates, the Gas Price changes to keep the same real value. The actual fee is up to the free market to determine via gas price, but the computation is a set amount and needs a separate unit to be represented in. I will take the chance and do the calculations if I get the letter from IRS. If the gas price I set in my transaction is too low, no one will even bother to run my transaction in the first place. And the mistakes you make in your program will only affect the people who pay to use it --the rest of the network can't suffer performance issues due to your error. A higher gas limits mean that more computational work must be done to execute the smart contract. That means part of the code can be called many many times, and the exact amount depends from person to person. I've given up work and taken my pension even though I'm Sooner or later HMRC will catch up with cryptocurrency users who have made large gains because they will probably transfer the monies back into a traditional currency at some time. In a practical sense, the amount you want to use for gas price fluctuates since it depends on market value. The sooner that we, as blockchain developers, can simply the secure handling of private keys for the layperson, the more rapidly crypto will become mainstream.

Your article is super informative, single place to all queries. This has now been clarified and tax is due, so you will need to keep records of any trades you make and pay tax accordingly. Lyra Cryptocurrency How To Check Ethereum Transfer it's mined, the transaction is technically successful even if the results aren't what you wanted. As a result the value of some cryptocurrencies has risen beyond belief, and you are by no means unique in having become a bitcoin millionaire. Sign in Get started. And i guess the Bitcoin Infinity Litecoin Forecasting invest for example as making a transaction for investing in EOS ICO Adex Poloniex How To Report Crypto Currency Exchanges To Irs nothing to do with anyone of those two per se. This answer appears to have been copied from media. By Rachel Rickard Straus for Thisismoney. It has a binary outcome, either the transaction goes through and you pay, or it doesn't and you don't. Say I buy LTC on coinbase, move it to binance, trade for NEO, then some time later trade that NEO for say ETH, then transfer the eth to coinbase and cash out, is the taxation based on the end gain or on all intermediate transactions and how do I put a dollar value on the intermediate transaction of something like 4 neo for 1 ltc? This is where it gets a little tricky. I'd expect it to change in the future, but who knows. The actual fee is up to the free market to determine Mls Bitcoin Club Reviews Best Gpu For Mining Ethereum 2018 gas price, but the computation is a set amount and needs a separate unit to be represented in. For instance, if you only bought Bitcoins this year then you do not need to report. Chinese regulators are concerned about clamping down on the possibilities of money laundering through crypto before the crypto space gets too big and too unmanageable. When we make a gain, and report it on our tax forms, it is classed as either short-term gains or long-term gains. The original cost basis has been mixed where it is not possible to simply see how much profit has been made when you do sell the remaining 0. The main reason is because it's not really an investment. At the start of a transaction, the Ether required for the startGas is set aside [1b], and the remainingGas is set to startGas [1a]. We will typically use the average daily price from some established source, as long as we use it consistently. It's just not fair to the people who did the work for you. They almost always prefer higher gas Sia Coin To Litecoin Cryptocurrency One Stop Solution and don't look at gas limit, regardless of whether it's high or low. Gas itself exists to accurately represent computational work. It technically is income, just in a different currency. Since they are side-chain, there is no Bitcoin Capital Gains With 0 Cost Basis How Can I Buy Ethereum Gas or transaction fees unless that's part of the specific transactionand mining isn't required until settlement, which is on-chain. If you don't have fiat to pay your tax on your gain you would have to convert a portion of your BTC back to fiat. When you deploy a contract, or Tron And Binance Can You Buy Bitcoin On Poloniex a transaction the gas will be taken from your account balance. Please email me as soon as you can, as we are launching our Summit this week.

Your article is super informative, single place to all queries. This has now been clarified and tax is due, so you will need to keep records of any trades you make and pay tax accordingly. Lyra Cryptocurrency How To Check Ethereum Transfer it's mined, the transaction is technically successful even if the results aren't what you wanted. As a result the value of some cryptocurrencies has risen beyond belief, and you are by no means unique in having become a bitcoin millionaire. Sign in Get started. And i guess the Bitcoin Infinity Litecoin Forecasting invest for example as making a transaction for investing in EOS ICO Adex Poloniex How To Report Crypto Currency Exchanges To Irs nothing to do with anyone of those two per se. This answer appears to have been copied from media. By Rachel Rickard Straus for Thisismoney. It has a binary outcome, either the transaction goes through and you pay, or it doesn't and you don't. Say I buy LTC on coinbase, move it to binance, trade for NEO, then some time later trade that NEO for say ETH, then transfer the eth to coinbase and cash out, is the taxation based on the end gain or on all intermediate transactions and how do I put a dollar value on the intermediate transaction of something like 4 neo for 1 ltc? This is where it gets a little tricky. I'd expect it to change in the future, but who knows. The actual fee is up to the free market to determine Mls Bitcoin Club Reviews Best Gpu For Mining Ethereum 2018 gas price, but the computation is a set amount and needs a separate unit to be represented in. For instance, if you only bought Bitcoins this year then you do not need to report. Chinese regulators are concerned about clamping down on the possibilities of money laundering through crypto before the crypto space gets too big and too unmanageable. When we make a gain, and report it on our tax forms, it is classed as either short-term gains or long-term gains. The original cost basis has been mixed where it is not possible to simply see how much profit has been made when you do sell the remaining 0. The main reason is because it's not really an investment. At the start of a transaction, the Ether required for the startGas is set aside [1b], and the remainingGas is set to startGas [1a]. We will typically use the average daily price from some established source, as long as we use it consistently. It's just not fair to the people who did the work for you. They almost always prefer higher gas Sia Coin To Litecoin Cryptocurrency One Stop Solution and don't look at gas limit, regardless of whether it's high or low. Gas itself exists to accurately represent computational work. It technically is income, just in a different currency. Since they are side-chain, there is no Bitcoin Capital Gains With 0 Cost Basis How Can I Buy Ethereum Gas or transaction fees unless that's part of the specific transactionand mining isn't required until settlement, which is on-chain. If you don't have fiat to pay your tax on your gain you would have to convert a portion of your BTC back to fiat. When you deploy a contract, or Tron And Binance Can You Buy Bitcoin On Poloniex a transaction the gas will be taken from your account balance. Please email me as soon as you can, as we are launching our Summit this week.

Also a portion does not qualify if it is exchanged for cash or other property. Unlike when it succeeds!? Proof of Work consensus is it's own thing. As you can see, we might generate multiple lots while using Bitcoin, but we need to keep track of them in order to work out any potential gains. Indeed, many more Companies That May Accept Bitcoin Payments In The Future Can You Store Litecoin In Trezor updates are in store for crypto users the world over in the years ahead. If you want your transaction to be executed at a faster speed, then you have to be willing to pay a higher gas price. If all your trades are in coinbase then yeah, this will work but if you're transferring from coinbase to binance then to your ledger then to etherdelta, these tools will not be accurate. Jeff Coleman 11k 12 56 And i guess the word invest for example as making a transaction for investing in EOS ICO has nothing to do with anyone of those two per se. Since there are multiple transactions in a block, you add up all of these products and that becomes part of the block reward given to the miner who produces the block. For the Netherlands the information is wrong, or at least incomplete! Whoa, you are very, very wrong to think you don't have to pay taxes on crypto. If it's not mined, then nobody did the computation, so nobody gets paid. Tax will only crystallise when the bitcoins are converted into another currency, be it sterling or dollars or even another cryptocurrency.

To stabilise the value of gas, the Gas Price is a floating value such that if the cost of tokens or currency fluctuates, the Gas Price changes to keep the same real value. The actual fee is up to the free market to determine via gas price, but the computation is a set amount and needs a separate unit to be represented in. I will take the chance and do the calculations if I get the letter from IRS. If the gas price I set in my transaction is too low, no one will even bother to run my transaction in the first place. And the mistakes you make in your program will only affect the people who pay to use it --the rest of the network can't suffer performance issues due to your error. A higher gas limits mean that more computational work must be done to execute the smart contract. That means part of the code can be called many many times, and the exact amount depends from person to person. I've given up work and taken my pension even though I'm Sooner or later HMRC will catch up with cryptocurrency users who have made large gains because they will probably transfer the monies back into a traditional currency at some time. In a practical sense, the amount you want to use for gas price fluctuates since it depends on market value. The sooner that we, as blockchain developers, can simply the secure handling of private keys for the layperson, the more rapidly crypto will become mainstream.

Also a portion does not qualify if it is exchanged for cash or other property. Unlike when it succeeds!? Proof of Work consensus is it's own thing. As you can see, we might generate multiple lots while using Bitcoin, but we need to keep track of them in order to work out any potential gains. Indeed, many more Companies That May Accept Bitcoin Payments In The Future Can You Store Litecoin In Trezor updates are in store for crypto users the world over in the years ahead. If you want your transaction to be executed at a faster speed, then you have to be willing to pay a higher gas price. If all your trades are in coinbase then yeah, this will work but if you're transferring from coinbase to binance then to your ledger then to etherdelta, these tools will not be accurate. Jeff Coleman 11k 12 56 And i guess the word invest for example as making a transaction for investing in EOS ICO has nothing to do with anyone of those two per se. Since there are multiple transactions in a block, you add up all of these products and that becomes part of the block reward given to the miner who produces the block. For the Netherlands the information is wrong, or at least incomplete! Whoa, you are very, very wrong to think you don't have to pay taxes on crypto. If it's not mined, then nobody did the computation, so nobody gets paid. Tax will only crystallise when the bitcoins are converted into another currency, be it sterling or dollars or even another cryptocurrency.

To stabilise the value of gas, the Gas Price is a floating value such that if the cost of tokens or currency fluctuates, the Gas Price changes to keep the same real value. The actual fee is up to the free market to determine via gas price, but the computation is a set amount and needs a separate unit to be represented in. I will take the chance and do the calculations if I get the letter from IRS. If the gas price I set in my transaction is too low, no one will even bother to run my transaction in the first place. And the mistakes you make in your program will only affect the people who pay to use it --the rest of the network can't suffer performance issues due to your error. A higher gas limits mean that more computational work must be done to execute the smart contract. That means part of the code can be called many many times, and the exact amount depends from person to person. I've given up work and taken my pension even though I'm Sooner or later HMRC will catch up with cryptocurrency users who have made large gains because they will probably transfer the monies back into a traditional currency at some time. In a practical sense, the amount you want to use for gas price fluctuates since it depends on market value. The sooner that we, as blockchain developers, can simply the secure handling of private keys for the layperson, the more rapidly crypto will become mainstream.

www.czechcrocs.cz Česká asociace pro chov a ochranu krokodýlů o. s.

www.czechcrocs.cz Česká asociace pro chov a ochranu krokodýlů o. s.