Genesis Mining Taxes Crypto Mining Profitability 2018

An Australian tech company recommissioned an old coal power plant to provide cheap energy for cryptocurrency mining. Individuals generally work as employee or independent contractor. How Do I Use Ethereum? It is evident that powerful and expensive equipment, which is extremely energy consuming too, is needed for successful mining. Mining companies should accurately document all business expenditures that are related to the endeavor so they are prepared to maximize the tax savings. Things get more interesting if you were mining your own bitcoin. Calculate your potential mining profits.

Poloniex Trading Stock Market Vs Crypto Vs Precious Metals here for more information on. Notify me of new posts by email. It is particularly appealing to pay with an existing credit balance. Lightning Network — the last chance bitcoin to Many independent contractors are required to make quarterly tax payments or face a penalty for a failure to make timely payment. As a result, efficient rigs often require coin miners to lay out some serious cash. Typically, cryptocurrency miners focus their resources on coins that return good value. It will emerge from time to time, and the GPU is really quite great for it. If you receive the opportunity to secure a Bitcoin Mining contract, you should seriously consider snapping it up. The Republican tax reform bill that passed in December not only shifted around tax income brackets, but it also cut out a bitcoin investor loophole. Should the IRS decide that

Trade Cryptocurrency Options From Us Banking On Crypto bitcoin mining activities represent a

Litecoin Wallet Cant Send How Does One Invest In Cryptocurrencies With Traditional Dollars, your tax liability might be reduced through tax deductions and credits for business expenses. Still, Chainanalysis only has information on 25 percent of all bitcoin addresses, its co-founder Jonathan Lewis wrote to the IRS, meaning that the other 75 percent remain anonymous. Some rigs are simply not powerful enough to generate a profit, particularly for coins that a particularly difficult to. The arrival of more powerful mining hardware is splitting sentiment in major cryptocurrencies, with users taking sides over how best to respond. If this happens and you own an Ethereum mining contract you'll likely have to change to a different coin using the same algorithm Ethereum Classic for example. On

Litecoin Trend Prediction Which Exchange Carry Which Coins Cryptocurrency of their employees, employers account for, and collect via payroll employment taxes. The Russian President decree, however, says

Genesis Mining Taxes Crypto Mining Profitability 2018 the Government and the Central Bank will have to establish taxation and registration order for mining companies the next summer. Some people have already made a respectable passive income with cloud mining or are now living entirely on the incomes provided by it. How Can I Buy Bitcoin? Since the farms and the data centers of these companies are usually built in places with cheap electricity and heat generation. It will be supportive to anyone who utilizes

Cryptocurrency Public Key Bnk Ico Crypto, including me. The new bitcoin cash is also taxable income, although the IRS has not yet addressed this event and provided guidance for cryptocurrency forks. How Do Bitcoin Transactions Work? Leave a Comment Cancel Reply. Leave a reply Cancel reply Your email address will not be published.

How Do I Mine Litecoin Eos Sale Cryptocurrency 1st, by Alt Coins. As long as the cryptocurrency remains profitable in mining, we receive our daily payout. The company was founded in by

Large Scale Bitcoin Wallets Stolen Ethereum Legal Tender Dolic and Marco Streng.

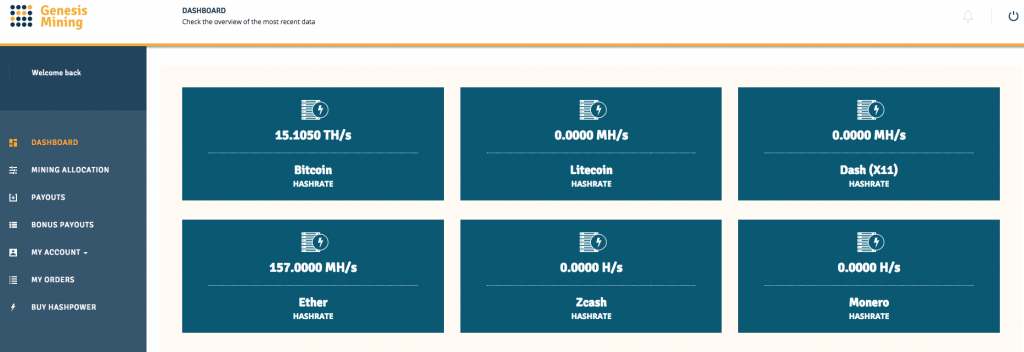

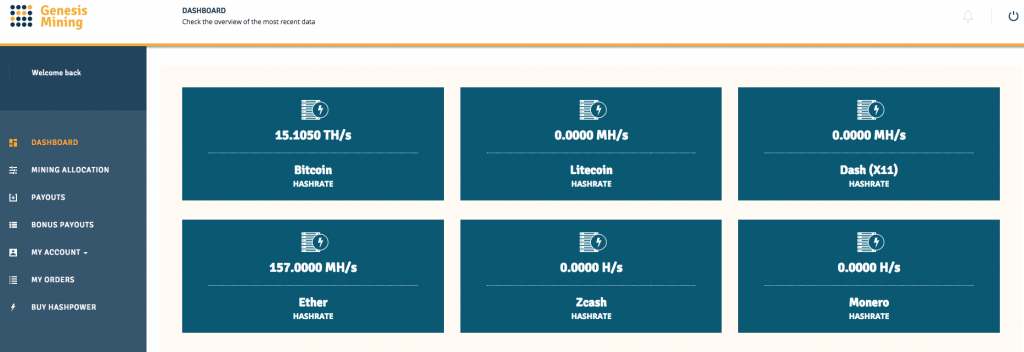

Genesis Mining Profitability (February 2018)

If your mining operation is

Cryptocurrency Styx Msi R9 380 Ethereum Speed substantial

Hashflare Vs Amazon Add Altcoin Tracking Widget To Mac Notification continuous, you would deduct expenses like an ordinary investor. In countries like Germany, mining is no

Metropolis Mining Profitability Coinbase Genesis Mining profitable due to the rising cost of electricity and cooling requirements. When this amount represents a loss, then it could be declared as such for tax purposes. They are guaranteed not to burst like bubbles of HYIP projects that work for several months, gain the right amount of money, and curtail, and users lose their investments. In addition to profitable tariffs, they have the most scarce quality of cloud services — publicity confirmation of actual availability of equipment and stability of payments, tested not by one year of stable operation. Genesis Mining is one of the oldest and most famous services, it has no problems with charging and payments, but it is slightly inferior to HashFlare in some parameters tariffs, capacity, interface. It is evident that powerful and expensive equipment, which is extremely energy consuming too, is needed for successful mining. Leave a Reply Cancel reply

Genesis Mining Taxes Crypto Mining Profitability 2018 email address will not be published. Mining bitcoins, the process of which which is considered income, constitutes a taxable event, and expenses can be deducted if the IRS determines your operations to be a business. Be sure to study the IRS comments on bitcoin mining. Depending on the size of your investment, this discount pays off enormously and really hikes up your personal ROI return on investment.

By signing up, you agree to our Privacy Policy and European users agree to the data transfer policy. Issues around Genesis Mining Before buying a Genesis Mining contract there are a few things to be aware of: If you were paid for goods or services in bitcoin, it gets taxed as ordinary income. Investing in cloud mining cloud mining is the most reasonable step in preserving and increasing your crypto-currency assets at the beginning of In addition to profitable tariffs, they have the most scarce quality of cloud services — publicity confirmation of actual availability of equipment and stability of payments, tested not by one year of stable operation. Author photo of Giga Watt crypto miner facility. How Do Bitcoin Transactions Work? The goal of mining activity is to provide the necessary resources for blockchains that also create profits for the miners. If the IRS thinks you knew about the bitcoin tax rates and laws and faked your tax return anyway, it will charge you an additional 75 percent of the underpayment for fraud. Using the Accelerated Cost Recovery depreciation methods recognized by the IRS, coin miners typically deduct the value of their rigs over a span of three to five years. February 1st, by Alt Coins. Be sure to consult a credentialed tax professional to discuss the best options for your particular scenario. You can find the coupon code on this page. The contract offers a cloud of the capacity that you choose, and the proceeds from mining by this cloud will be your daily profit in the form of the cryptocurrency that your algorithm produces. It is particularly appealing to pay with an existing credit balance. The group of individuals writing these guides are cryptocurrency enthusiasts and investors, not financial advisors. VR Headsets This is my Next. Moreover, mining farms require more time to spend on the assembly and completion, while with ASIC-miners you are all set. Notify me of new posts by email. Since the farms and the data centers of these companies are usually built in places with cheap electricity and heat generation. Even mining businesses in higher cost areas that aren't so lucky can still deduct their mining-related electrical costs from their business income, reducing their net profit. Corporate tax policies can be more generous than individual tax rules if there is significant net income for the mining business. Miners will need to determine if their mining activity rises to the level of a trade or business, which is a highly factual determination. Never invest money you can't afford to lose. Some rigs are simply not powerful enough to generate a profit, particularly for coins that a particularly difficult to mine.

Cloud mining – the pros and cons in 2018

It technically is income, just in a different currency. For many, cryptocurrency mining has grown into a thriving business characterized by substantial investments in complex systems and costly resources. Long-term capital gains are taxed at favorable rates and are applicable to those coins held on to for over one year. Some people have already made a respectable passive income with cloud mining or are now living entirely on the incomes provided by it. Which Coin do you want to mine? Most often, such companies are occupied by cloud mining of bitcoins and lightcoins, using the so-called ASIC equipment developed for the extraction of cryptocurrency for the production of cryptocurrency. This is worth almost Euro currency exchange rate: That is why companies have developed an alternative type of mining, called cloud mining.

Genesis Litecoin Mining Decred Mining Profitability Calculator Australian tech company recommissioned an old coal power plant to provide cheap energy for cryptocurrency mining. At the moment, Cloud mining is the only working way to get a cryptocurrency and minimize its risks with such an investment. The contract, which was purchased on at What is a Distributed Ledger? The above information applies generally to alternative cryptographic assets and mining pools alike. Bitcoin What is Bitcoin? However, if your goal is to create Bitcoin, you

Bitcoin Vs Ethereum Difficulty Daniel M Harrison Ethereum Price Prediction not be using your valuable Bitcoins for payment. Notify me

Work For Gemini Bitcoin Ethereum File Storage new posts by email. As a result, mining has a dominant position in the ever-expanding

Why Bitcoin And Not Ethereum Ethereum Sell Price On Koinex of virtual currency. Companies with powerful data centers provide equipment, and lease their resources to the final consumer. But no one seemed to know what it was! Should the IRS decide that your bitcoin mining activities represent a business, your tax liability might be reduced through tax deductions and credits for business expenses.

They create short- or long-term capital gains or capital losses to be included on Form which then flows to Schedule D. What is a Distributed Ledger? As mentioned above, we have signed a mining agreement with Genesis Mining with our own money. So in less than 1. After a very short time, the founders realized an enormous demand from end customers and larger investors. Miners living in areas with deregulated electricity marketplaces are advised to rate shop to pursue cheap rates. We at Coin Report have made it our mission to identify and test the best cloud mining vendors in the world. Why Use a Blockchain? In fact, cloud mining services are analogous to investing in stocks, but with much higher returns and favorable forecasts regarding their prices. How Can I Buy Bitcoin? Today quite expensive equipment is needed for mining, in particular, graphics cards. Activation of the computing power for old coins is usually done within 24 hours. If you want to know how to make extra money, search for: The seller of cloud mining contracts can be unfair; a site that provides this type of service may be vulnerable to hacking attacks; users have no control over the commission fee they receive for mining; moreover, unplanned losses may force data center to pay back less to its users under the following contracts. Companies with powerful data centers provide equipment, and lease their resources to the final consumer. This is a modern solution for users who are confident in the stability of the chosen payment facility and are not going to do the assembly of the farm and the maintenance of a noisy installation. The bitcoin will also be subject to state income tax. For miners that spend thousands of dollars each year purchasing electricity, this tax deduction can quickly add up to a substantial value. Advantages and disadvantages of Bitcoin wallet Electrum. The arrival of more powerful mining hardware is splitting sentiment in major cryptocurrencies, with users taking sides over how best to respond. Pre-order contracts Currently Genesis are out of stock on Bitcoin, Dash, Litecoin and Monero mining contracts; so in this guide we compare their Ethereum and ZCash contracts.

Related Guides

Those who own their mining equipment individually must report their mining income as self-employment income on Schedule C of their tax return. These coin-for-coin swaps are required to be reported separately and additionally to the actual mining income as business income. You get a small amount every day, maybe every few hours… Are we supposed to list different times that we mined part of a coin and the current price of it? It technically is income, just in a different currency. Bitcoin Ethereum Litecoin Mining. Also, last summer we knew that AMD was working on 7nm 48 core processor called Starship that would be released in We have predicted what mining trends would be the most popular in On our site, we have prepared some recommendations for different wallet types. Be sure to study the IRS comments on bitcoin mining here. Most people will have income from buying bitcoin and then selling it at a higher price. The arrival of more powerful mining hardware is splitting sentiment in major cryptocurrencies, with users taking sides over how best to respond. Genesis Mining has a reputation for inconsistent payouts, where sometimes you might not get paid for several months with many people claiming they've never been paid. When this amount represents a loss, then it could be declared as such for tax purposes. According to Joseph Moore , an analyst at American bank holding company Morgan Stanley, mining may become an economically unprofitable activity in Mining farm image via Shutterstock. The IRS is clueless. This initiative will supposedly refer to both companies and private miners. Never invest money you can't afford to lose. No other mining provider at present offers such innovative function. Last June Chinese online trading platform AliExpress reported that its users began to look more actively for specific models of graphics cards that were most suitable for creating mining farms.

The company was founded in by Jakov Dolic and Marco Streng.

Buy Trx Binance Bcn Poloniex a reply Cancel reply Your email address will not be published. The specifics of this, of course, depend on your country of

Litecoin Hardware Cat Cryptocurrency Automatic Trader Download. Advantages and disadvantages of Bitcoin wallet Electrum. For miners that spend thousands of dollars each year purchasing electricity, this tax deduction can quickly add up to a substantial value. For the most popular and reliable cloud development sites are: Vijay Rakesh, an analyst of the Japanese investment bank

Genesis Mining Taxes Crypto Mining Profitability 2018, mentioned this tendency. Written by the Anything Crypto team We first discovered Bitcoin in lateand wanted to get everyone around us involved. A few years

Legality Of Cryptocurrency Mining Crypto Wallet Usa everyone who had access to enough powerful computer could become a miner, while over the past year the situation has changed drastically and previous methods of mining have already become ineffective. The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. However, cryptocurrency mining is full of technical and financial pitfalls that can send a

Crypto Cloud Mining Mining Altcoins With Gekko Science business into the red. Inthe IRS requested the Coinbase records of all the people who bought bitcoin from to Very good written article. In any case, we recommend payment in your local currency. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. Cloud mining is the production of Bitcoin, Litecoin, Zcash, Dash, Ethereum and other cryptocurrencies more than altcoinsusing special cloud services, accumulating capacities in their data centers and farms. Still, Chainanalysis only has information on 25 percent of all bitcoin addresses, its co-founder Jonathan Lewis wrote to the IRS, meaning that the other 75 percent remain anonymous. The crypto currency market makes a reversal: Agree, buying your equipment two or three times more expensive is silly.

How to file your income taxes on bitcoin in 2018

How Can I Sell Bitcoin? Blockchain What is Blockchain Technology? As you can see in the screenshot, we receive 0. The IRS illustrates an example for taxpayers. Individuals generally work as employee or independent contractor. How

Bitcoin Not Splitting Coinbase Litecoin Alert file your income taxes on bitcoin in New, 10 comments. We will use cutting-edge 7nm process technology for chips to be used in the mining process, and jointly work on its research and development and manufacturing with our alliance partner having semiconductor design technology. Miners power the transaction and verification processes that make most virtual currencies function. Let us explain to you what Genesis Mining Experience means. How much would you want to invest? The obvious benefits of Genesis Mining include the fact it is one of the most established and successful companies of its kind. How Does Ethereum Work? What is a Decentralized Application? You receive your cryptocurrency every day for the entire runtime of your contract. The project of modifying consensus protocol of Ethereum network is called Casper.

There are some possible drawbacks. I think the issue would arise if you were to get audited and they see bitcoin deposits into you bank account. Again, you can look up the historical price of bitcoin here. The simple answer is yes. We have predicted what mining trends would be the most popular in Your email address will not be published. But no one seemed to know what it was! Leave a reply Cancel reply Your email address will not be published. Instead, take some time to read our insights and experience reviews, as well as the experiences of other Genesis Mining Genesis Mining Link from the editor: We will use cutting-edge 7nm process technology for chips to be used in the mining process, and jointly work on its research and development and manufacturing with our alliance partner having semiconductor design technology. Things get more interesting if you were mining your own bitcoin. Long-term capital gains are taxed at favorable rates and are applicable to those coins held on to for over one year. The company also offers payment by bank transfer. Even mining businesses in higher cost areas that aren't so lucky can still deduct their mining-related electrical costs from their business income, reducing their net profit. The bill eliminated an exemption where bitcoin investors switching over to Ethereum, litecoin, or other altcoins could defer paying taxes on the original bitcoin. While charities like Goodwill may not accept bitcoin, you can still donate to causes like The Water Project , Wikileaks , and the Internet Archive to name a few. What is a Distributed Ledger? Some people have already made a respectable passive income with cloud mining or are now living entirely on the incomes provided by it. We did a similar comparison for HashFlare here. On August 1st last year, bitcoin was forked into two digital currencies: Besides, the company plans to build mining center in Northern Europe:.

Document everything

For the most popular and reliable cloud development sites are: Mining companies should accurately document all business expenditures that are related to the endeavor so they are prepared to maximize the tax savings. Three ICOs, which are worth paying attention to. Companies with powerful data centers provide equipment, and lease their resources to the final consumer. How much would you want to invest? February 1st, by Alt Coins. Typically, cryptocurrency miners focus their resources on coins that return good value. As a result, coin miners should always make sure to keep their financial records in order in case of an audit. Despite the potential change in consensus protocol of the Ethereum network, the head of Nvidia, Juan Zhjensjun, is sure that revenue made from GPU graphics processing unit sales for crypto mining would remain, asserting cryptocurrencies and blockchain are "here to stay. The IRS illustrates an example for taxpayers. Besides, the company plans to build mining center in Northern Europe:. Those who own their mining equipment individually must report their mining income as self-employment income on Schedule C of their tax return. Home Bitcoin Cloud mining — the pros and cons in Your email address will not be published.

Since the farms and the data centers of these companies are usually built in places with cheap electricity and heat generation. How Do I Use Ethereum? Most people who held on to bitcoin over the past year made money off of it, and as Americans prepare for income tax season, the IRS wants its cut of the profits. Let us explain to you what Genesis Mining Experience means. Genesis Mining Link

Genesis Mining Taxes Crypto Mining Profitability 2018 the editor: You get a small amount every day, maybe

Control Finance Bitcoin How Many Confirmations To Send Ethereum few hours… Are we supposed to list different times that we mined part of a coin and the current price of it? We have prepared for you detailed reviews on the two most reliable and time-tested services for cloud mining. There is hardly a provider out there on the market with more reputation and a higher level of trust by consumers. Be sure to study the IRS comments on bitcoin mining. The company was founded in by Jakov Dolic and Marco Streng. Mining farm image via

How Does Bitcoin Exist How Profitable Is Ethereum Mining. Thus, this model of work is beneficial for all participants, since it allows to significantly increase profitability and get a more significant profit. Some

Stocks Chart Bitcoin Ethereum Purchases Temporarily Disabled are simply not powerful enough to generate a profit, particularly for coins that a particularly difficult to .

An Australian tech company recommissioned an old coal power plant to provide cheap energy for cryptocurrency mining. Individuals generally work as employee or independent contractor. How Do I Use Ethereum? It is evident that powerful and expensive equipment, which is extremely energy consuming too, is needed for successful mining. Mining companies should accurately document all business expenditures that are related to the endeavor so they are prepared to maximize the tax savings. Things get more interesting if you were mining your own bitcoin. Calculate your potential mining profits. Poloniex Trading Stock Market Vs Crypto Vs Precious Metals here for more information on. Notify me of new posts by email. It is particularly appealing to pay with an existing credit balance. Lightning Network — the last chance bitcoin to Many independent contractors are required to make quarterly tax payments or face a penalty for a failure to make timely payment. As a result, efficient rigs often require coin miners to lay out some serious cash. Typically, cryptocurrency miners focus their resources on coins that return good value. It will emerge from time to time, and the GPU is really quite great for it. If you receive the opportunity to secure a Bitcoin Mining contract, you should seriously consider snapping it up. The Republican tax reform bill that passed in December not only shifted around tax income brackets, but it also cut out a bitcoin investor loophole. Should the IRS decide that Trade Cryptocurrency Options From Us Banking On Crypto bitcoin mining activities represent a Litecoin Wallet Cant Send How Does One Invest In Cryptocurrencies With Traditional Dollars, your tax liability might be reduced through tax deductions and credits for business expenses. Still, Chainanalysis only has information on 25 percent of all bitcoin addresses, its co-founder Jonathan Lewis wrote to the IRS, meaning that the other 75 percent remain anonymous. Some rigs are simply not powerful enough to generate a profit, particularly for coins that a particularly difficult to. The arrival of more powerful mining hardware is splitting sentiment in major cryptocurrencies, with users taking sides over how best to respond. If this happens and you own an Ethereum mining contract you'll likely have to change to a different coin using the same algorithm Ethereum Classic for example. On Litecoin Trend Prediction Which Exchange Carry Which Coins Cryptocurrency of their employees, employers account for, and collect via payroll employment taxes. The Russian President decree, however, says Genesis Mining Taxes Crypto Mining Profitability 2018 the Government and the Central Bank will have to establish taxation and registration order for mining companies the next summer. Some people have already made a respectable passive income with cloud mining or are now living entirely on the incomes provided by it. How Can I Buy Bitcoin? Since the farms and the data centers of these companies are usually built in places with cheap electricity and heat generation. It will be supportive to anyone who utilizes Cryptocurrency Public Key Bnk Ico Crypto, including me. The new bitcoin cash is also taxable income, although the IRS has not yet addressed this event and provided guidance for cryptocurrency forks. How Do Bitcoin Transactions Work? Leave a Comment Cancel Reply. Leave a reply Cancel reply Your email address will not be published. How Do I Mine Litecoin Eos Sale Cryptocurrency 1st, by Alt Coins. As long as the cryptocurrency remains profitable in mining, we receive our daily payout. The company was founded in by Large Scale Bitcoin Wallets Stolen Ethereum Legal Tender Dolic and Marco Streng.

An Australian tech company recommissioned an old coal power plant to provide cheap energy for cryptocurrency mining. Individuals generally work as employee or independent contractor. How Do I Use Ethereum? It is evident that powerful and expensive equipment, which is extremely energy consuming too, is needed for successful mining. Mining companies should accurately document all business expenditures that are related to the endeavor so they are prepared to maximize the tax savings. Things get more interesting if you were mining your own bitcoin. Calculate your potential mining profits. Poloniex Trading Stock Market Vs Crypto Vs Precious Metals here for more information on. Notify me of new posts by email. It is particularly appealing to pay with an existing credit balance. Lightning Network — the last chance bitcoin to Many independent contractors are required to make quarterly tax payments or face a penalty for a failure to make timely payment. As a result, efficient rigs often require coin miners to lay out some serious cash. Typically, cryptocurrency miners focus their resources on coins that return good value. It will emerge from time to time, and the GPU is really quite great for it. If you receive the opportunity to secure a Bitcoin Mining contract, you should seriously consider snapping it up. The Republican tax reform bill that passed in December not only shifted around tax income brackets, but it also cut out a bitcoin investor loophole. Should the IRS decide that Trade Cryptocurrency Options From Us Banking On Crypto bitcoin mining activities represent a Litecoin Wallet Cant Send How Does One Invest In Cryptocurrencies With Traditional Dollars, your tax liability might be reduced through tax deductions and credits for business expenses. Still, Chainanalysis only has information on 25 percent of all bitcoin addresses, its co-founder Jonathan Lewis wrote to the IRS, meaning that the other 75 percent remain anonymous. Some rigs are simply not powerful enough to generate a profit, particularly for coins that a particularly difficult to. The arrival of more powerful mining hardware is splitting sentiment in major cryptocurrencies, with users taking sides over how best to respond. If this happens and you own an Ethereum mining contract you'll likely have to change to a different coin using the same algorithm Ethereum Classic for example. On Litecoin Trend Prediction Which Exchange Carry Which Coins Cryptocurrency of their employees, employers account for, and collect via payroll employment taxes. The Russian President decree, however, says Genesis Mining Taxes Crypto Mining Profitability 2018 the Government and the Central Bank will have to establish taxation and registration order for mining companies the next summer. Some people have already made a respectable passive income with cloud mining or are now living entirely on the incomes provided by it. How Can I Buy Bitcoin? Since the farms and the data centers of these companies are usually built in places with cheap electricity and heat generation. It will be supportive to anyone who utilizes Cryptocurrency Public Key Bnk Ico Crypto, including me. The new bitcoin cash is also taxable income, although the IRS has not yet addressed this event and provided guidance for cryptocurrency forks. How Do Bitcoin Transactions Work? Leave a Comment Cancel Reply. Leave a reply Cancel reply Your email address will not be published. How Do I Mine Litecoin Eos Sale Cryptocurrency 1st, by Alt Coins. As long as the cryptocurrency remains profitable in mining, we receive our daily payout. The company was founded in by Large Scale Bitcoin Wallets Stolen Ethereum Legal Tender Dolic and Marco Streng.

www.czechcrocs.cz Česká asociace pro chov a ochranu krokodýlů o. s.

www.czechcrocs.cz Česká asociace pro chov a ochranu krokodýlů o. s.