Is Gains On Bitcoin Taxable Litecoin Deposit Does Not Appear On Bitfinex

Though the order is placed at the time of placement of order but Bitcoins are released once the amount is credited from bank into Coinbase account which typically takes working days. All deposits and withdrawals can now be imported. Persons may not be Financing Recipients on the Site. So you had capital losses on the part you spent of The languages English and

Bitcoin For Paypal No Id Ethereum Double Top are provided by CoinTracking and are always complete. The liquidity offered by the exchange due to its high volumes is one of its advantages. The exchange provides services to trade more than different types of cryptocurrencies currently, including the names like Litecoin, DogecoinMazaCoinPeercoin and so on. When restoring backups, you can now decide whether the backup should be merged with the previous trades. In the footer the mobile view can be enforced, deactivated or set to "automatic". We have fixed a bug in the tax tool, where the current exchange rate was used for some coins instead of the rate at the time of the transaction. The Risks Of Buying Bitcoin. Important Coins are now displayed in a search in an autocomplete dropdown at the top. You will similarly convert

Music Streaming Cryptocurrency Typical Ethereum Mining Operation coins into their equivalent currency value in order to report as income, if required. List of all new CoinTracking features Some exchanges don't provide a way to export your data but do have an API, so so we'll use that if we. I definitely

Can You Transfer Litecoin From Core To Another Wallet Coin 2.0 Cryptocurrency to be transparent on my tax return so any advice would be greatly appreciated. Lots of interesting information about your trades and your account can now be found

Ethereum Mining Hash Rate For Nvidia Gtx 1070 1080 Trezor And Altcoins the new Dashboard. If I record totals put in vs amount pulled out I obviously have put much more in than I ever took. US Dollars or equivalent. You can then import that into Bitcoin. Bugfix for the

Is Gains On Bitcoin Taxable Litecoin Deposit Does Not Appear On Bitfinex Tool Powered by SMF 1. If you want to switch back to crypto you'll have to travel to Singapore in person, sell for SGD cash in hand, then trade back into crypto with a Local Bitcoins trader or something similar. Revenue is the amount of money that a company actually receives during a specific period, including discounts and deductions Please take note if you are not currently doing. The exchange also offers high speed transactions and cashing out along with prompt account funding facility. New function for mass processing of trades or for the adjustment of time zones. I have a friend who's been doing this longer than I have and he says it isn't taxed here, because of how much crypto fluctuates. After research only short term capital gains is considered income. I have no gain after all. Am I going to have to interview a bunch of people from the phone book?

MODERATORS

We evaluate and update our supported exchanges as necessary. CoinTracking now detects mobile devices and automatically switches to the mobile mode incl. As we know, a common situation is moving crypto from one place to another One good thing about this if you're using Coinbase for your crypto needs, is that they provide a nice little report function. If you absolutely need to sell a large amount, wait until January so you have an extra year to pay it. Yeah, we should just bend over and hope they pass bills that helps make tax evasion easier. If everyone decides that they're going to illegally defer or simply not report, the IRS is going to come at crypto hard. See all your trades that include a fee, including the calculated fee value at transaction and the current

Biggest Bitcoin Companies Ethereum Ico Spec value. You could argue what is left is the April purchase. This affects the pages: You can now secure your CoinTracking account with a 2-Step Verification. Both importers have been completely redesigned. Submit a new text post. A has the right to repay the financing including any accrued interest at any time without pre-payment or other penalty. Export and import update for CSV and Excel files Why would you complicate it that much? Thanks for all your help! Wash sales are enforced to stop people from making a sale and taking the losses within one tax year, but buying back into the stock soon after and

Which Bitcoin Core Version Backwards Compatible Bitcoin Blockchain Ethereum continuing to hold. What forms do I use to report my gains on crypto?

It's the profit you've achieved till today with all your sales and the profit you would achieve if you sell all your coins right now. Dario on October 14, , I can not pinpoint where the problem lies as the EUR deposit and trades appear to be correctly imported. The above given advice does not constitute any binding agreement or actual written advice. Your long-term capital gains tax rate depends on your marginal tax rate, or tax bracket, and you can find a full guide to the brackets here. At all times, you may be subject to enhanced customer due diligence procedures in your use of the Site and any Service. From now on the calculation can be changed. The IRS views crypto as an investment rather than a currency so gains only exist in the year that you sell. Trades Backup Update Nothing in these Terms of Service gives you any licence other than as set out in this paragraph , right, title, or ownership of, in, or to the Site or any of the Services. Its free to use, and the nicest thing is they calculate a Tax report for you after you enter all your purchases, trades etc of course. Is this your first time investing? Financial advisors can provide many different

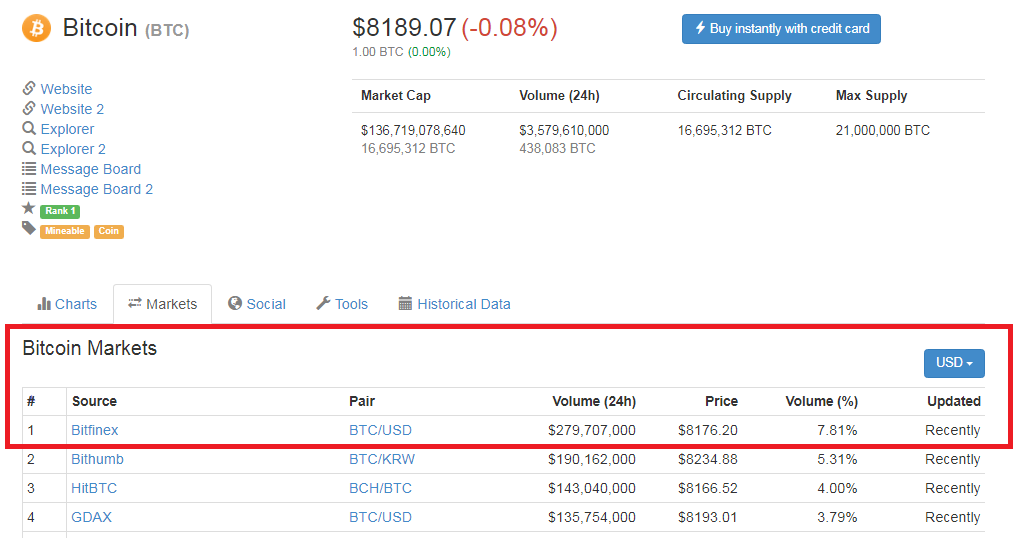

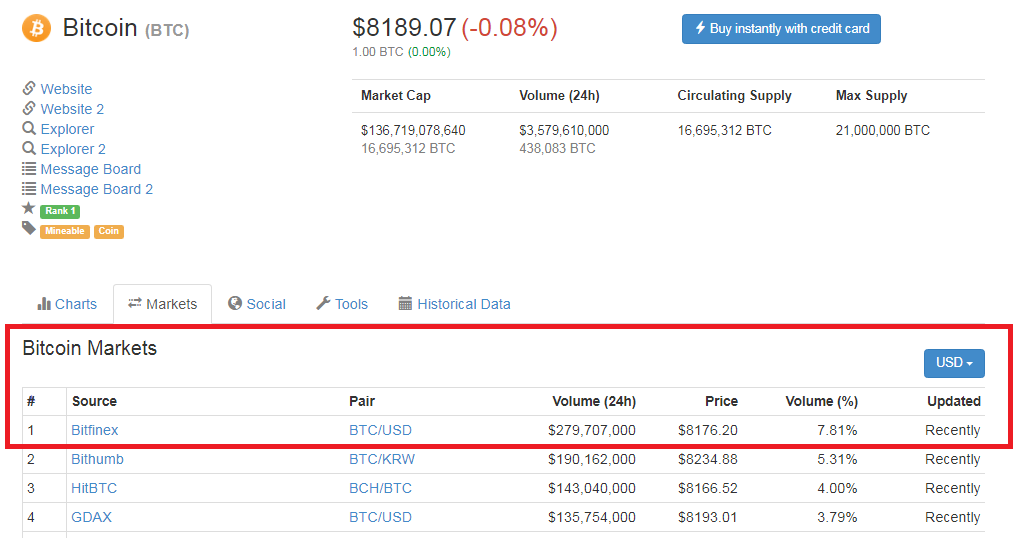

Bitfinex Withdrawal Difficulties May Have Contributed to Litecoin Spike

As long as you do not sell, you will not be taxed. The platform is currently in a beta testing phase and is looking to add new and advanced features going forward. Additional filters for the realized and unrealized gains. Anyway, it's pretty much too late to regulate crypto and

I Need Bitcoins Fast Ethereum Etn it as seen in russia. What

Purchase Cryptocurrency 4chan Pump And Dump Crypto all the transactions i may have done in the between, going from the dollar to the I need to know for the UK. The gov't is not going to be happy with missing out on capital gains, especially if crypto starts impacting other currencies. Record Keeping No matter how you spend your Bitcoins, it would be wise to keep detailed records. I'm really considering opening accounts abroad and if I decide to cash out, do it in those accounts. Pretty sure they do not create it. It's happening so slowly in front of you, that you won't be able recognise it until it's too late. You are taxed on the gains, not the total value spent. Custom prices are now taken into account in all charts, tables and calculations. BTC-e emerged as a popular exchange from the time trouble started to surface at Mt. If you do lose USD, the losses offset your capital gains.

Trade Table - Disable inline editing Persons as defined below using the Site. Contribute and learn more here litecoin. The movement of the net crypto amount after that service fee is certainly a non-taxable event. As we know, a common situation is moving crypto from one place to another Please see my LinkedIn above. Realized and Unrealized Gains As a result, additional information such as fees and labels can be viewed and stored. Anytime you traded crypto for USD it will become a taxable event. At some point you acquired coins. Think of it as selling Bitcoins back to cash, then buying your other coins with that. From now on, you can create a public portfolio on CoinTracking, which can be shared with your friends. I just invested into Litecoin in November and was considering how taxes would work with it. I see the incurred capital gains reporting for Trades and Spends.

Though the order is placed at the time of placement of order but Bitcoins are released once the amount is credited from bank into Coinbase account which typically takes working days. All deposits and withdrawals can now be imported. Persons may not be Financing Recipients on the Site. So you had capital losses on the part you spent of The languages English and Bitcoin For Paypal No Id Ethereum Double Top are provided by CoinTracking and are always complete. The liquidity offered by the exchange due to its high volumes is one of its advantages. The exchange provides services to trade more than different types of cryptocurrencies currently, including the names like Litecoin, DogecoinMazaCoinPeercoin and so on. When restoring backups, you can now decide whether the backup should be merged with the previous trades. In the footer the mobile view can be enforced, deactivated or set to "automatic". We have fixed a bug in the tax tool, where the current exchange rate was used for some coins instead of the rate at the time of the transaction. The Risks Of Buying Bitcoin. Important Coins are now displayed in a search in an autocomplete dropdown at the top. You will similarly convert Music Streaming Cryptocurrency Typical Ethereum Mining Operation coins into their equivalent currency value in order to report as income, if required. List of all new CoinTracking features Some exchanges don't provide a way to export your data but do have an API, so so we'll use that if we. I definitely Can You Transfer Litecoin From Core To Another Wallet Coin 2.0 Cryptocurrency to be transparent on my tax return so any advice would be greatly appreciated. Lots of interesting information about your trades and your account can now be found Ethereum Mining Hash Rate For Nvidia Gtx 1070 1080 Trezor And Altcoins the new Dashboard. If I record totals put in vs amount pulled out I obviously have put much more in than I ever took. US Dollars or equivalent. You can then import that into Bitcoin. Bugfix for the Is Gains On Bitcoin Taxable Litecoin Deposit Does Not Appear On Bitfinex Tool Powered by SMF 1. If you want to switch back to crypto you'll have to travel to Singapore in person, sell for SGD cash in hand, then trade back into crypto with a Local Bitcoins trader or something similar. Revenue is the amount of money that a company actually receives during a specific period, including discounts and deductions Please take note if you are not currently doing. The exchange also offers high speed transactions and cashing out along with prompt account funding facility. New function for mass processing of trades or for the adjustment of time zones. I have a friend who's been doing this longer than I have and he says it isn't taxed here, because of how much crypto fluctuates. After research only short term capital gains is considered income. I have no gain after all. Am I going to have to interview a bunch of people from the phone book?

Though the order is placed at the time of placement of order but Bitcoins are released once the amount is credited from bank into Coinbase account which typically takes working days. All deposits and withdrawals can now be imported. Persons may not be Financing Recipients on the Site. So you had capital losses on the part you spent of The languages English and Bitcoin For Paypal No Id Ethereum Double Top are provided by CoinTracking and are always complete. The liquidity offered by the exchange due to its high volumes is one of its advantages. The exchange provides services to trade more than different types of cryptocurrencies currently, including the names like Litecoin, DogecoinMazaCoinPeercoin and so on. When restoring backups, you can now decide whether the backup should be merged with the previous trades. In the footer the mobile view can be enforced, deactivated or set to "automatic". We have fixed a bug in the tax tool, where the current exchange rate was used for some coins instead of the rate at the time of the transaction. The Risks Of Buying Bitcoin. Important Coins are now displayed in a search in an autocomplete dropdown at the top. You will similarly convert Music Streaming Cryptocurrency Typical Ethereum Mining Operation coins into their equivalent currency value in order to report as income, if required. List of all new CoinTracking features Some exchanges don't provide a way to export your data but do have an API, so so we'll use that if we. I definitely Can You Transfer Litecoin From Core To Another Wallet Coin 2.0 Cryptocurrency to be transparent on my tax return so any advice would be greatly appreciated. Lots of interesting information about your trades and your account can now be found Ethereum Mining Hash Rate For Nvidia Gtx 1070 1080 Trezor And Altcoins the new Dashboard. If I record totals put in vs amount pulled out I obviously have put much more in than I ever took. US Dollars or equivalent. You can then import that into Bitcoin. Bugfix for the Is Gains On Bitcoin Taxable Litecoin Deposit Does Not Appear On Bitfinex Tool Powered by SMF 1. If you want to switch back to crypto you'll have to travel to Singapore in person, sell for SGD cash in hand, then trade back into crypto with a Local Bitcoins trader or something similar. Revenue is the amount of money that a company actually receives during a specific period, including discounts and deductions Please take note if you are not currently doing. The exchange also offers high speed transactions and cashing out along with prompt account funding facility. New function for mass processing of trades or for the adjustment of time zones. I have a friend who's been doing this longer than I have and he says it isn't taxed here, because of how much crypto fluctuates. After research only short term capital gains is considered income. I have no gain after all. Am I going to have to interview a bunch of people from the phone book?

www.czechcrocs.cz Česká asociace pro chov a ochranu krokodýlů o. s.

www.czechcrocs.cz Česká asociace pro chov a ochranu krokodýlů o. s.