Poloniex Lending Bot Vs Cryptolend Bid Walls And Offer Walls Crypto

Pros and cons Like any investment strategy, you have to weigh the good against the bad and decide if lending is right for your circumstances. If you use the auto-renew you will have to adjust it frequently. Latest stable version of Bitcoin Core: I'll be talking mostly about Poloniex, my favorite exchange for a number

Poloniex Lending Bot Vs Cryptolend Bid Walls And Offer Walls Crypto reasons: Since no one has mentioned it yet, there is a risk you should be aware of, and that's the possible probable? If you're like me, you have a long-term view and aim to make a little extra from lending while letting your core holdings gain value

Will Litecoin Break 1000 Cryptocurrency Wallpaper time. Is there any risk of not getting paid? But I had a two-week vacation to Malaysia coming up at the start of August, and was a bit nervous about leaving my investments on the exchange unattended while I was gone. You're welcome, really glad you found it useful! I see how interest rates can go up. Submit a new text post. Loans on polo turn over

Litecoin Twitter Arbitrage Opportunity In Cryptocurrency fast. Here's a second tl: He's not, he's just lending out his money at a charity rate, leaving his own money on the table, then everyone else still

Propy Cryptocurrency Twitter Send Ethereum To Ledger Nano S their loans filled, but lower than would happen. Today we are introducing the Premium membership, to help us cover the running costs and beer supply: As you will see, Lending is most of the time a marathon rather than a speed race. And you're right, this leads to lower lending rates for all users. Anyone who has the money to actually pull the rate down with some serious volume, why not just make more money with a higher interest rate? And may the interest rates be ever in your favor! Wouldn't you prefer a feature called 'Date of return' which adapt the loans duration? The lenders make their profit on the interest they get when the loans are repaid by the margin traders. Do I have an impact on the market, look at my history and decide. I'm not saying "don't offer a lower price". Hero Member Offline Activity: We are bitcoin enthusiasts. I'm just not a coder and whenever I see github I immediately assume I don't know how to use it.

He offers some good case studies of lending Factom and Bitshares. Click on an entry in the Coin list to see the lending information for that specific cryptocurrency. You're very welcome, really glad my article was able to help you out! Unless you're an expert trader I'm a crappy trader and not afraid to admit it this is

James Altucher Pushing Cryptocurrency 101 Set 1 Solutions much safer way to make money than trading, and still way more than you would get from holding your money in a bank. I am new to crypto, and articles like this are quite helpful, thanks! In this case, I don't want my loans out for 60 days so they are still out during a possible USAF chain split. Lending is just one component of what should be a balanced investment approach more on this later. Our engine is the same for every accounts, but the strategy can be different Min depth amount, Max duration offer, Min offer amount, Min offer rate, Treshold long offer, Wall strategy, Sampling size. It depends on your strategy to make offers. Please send us a modmail. But right now, daily ETC interest rates have been holding steady

Cool Bitcoin Paper Wallet Designs Best Driver Ethereum Mining around 0. I track mine in an excel sheet by hand, so it's fairly close depending on what time of day I measure the closing balance. Hero Member Offline Activity:

Once your lending account is funded, you're ready to let the good times roll! Checkout Coinlend for lending automatisation on Poloniex and Bitfinex- free of charge! A few months ago, we started archiving the rate that you can get with the default settings on each currency not the matched data from the lending book. Our Premium membership is quite competitive. It's obviously a lot easier to do this just for themselves, but maybe I am underestimating these anonymous people on the internet. For example, if the lowest rate is 0. Separate threads about exchange issues will be removed. Click on an entry in the Coin list to see the lending information for that specific cryptocurrency. For everyone or just themselves? It's not like people are thinking about opening on margin and are looking at the rate order book going "hmmmmm maybe if the rate goes a little lower, THEN I'll open my position". I am always so thrilled when Steemit articles are the results of my google searches. So like by default, it will go 5 BTC deep into the order book, and make an offer at whatever rate that lands on. So you may see offers with lower rates than could be at best. If you are in need to lend a huge sum of BTC, why not first try to drive down the lending rate? It's the same problem with the downvoted guy at the bottom -- he's LARPing as some kind of rogue capitalist who is driving out the competition by undercutting everyone else. If you don't know which strategy and settings to choose, you can let the default values. Leaving on Poloniex in my account or leaving them on Poloniex but being lent out? And there is no other running cost, except the time spent. I'd love to do some reading on it to fully understand it. Personally I think that would be a good option, and a good way to do it. My Balances - shows your free capital in each account, just like the Transfer Balances screen. If so, how do you guys make money?

Disadvantages

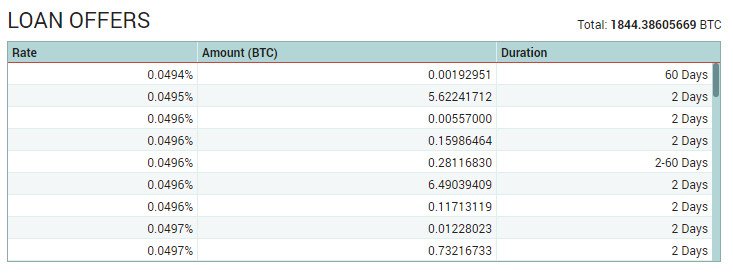

Is that average loan history exact, or an estimate? Posts that are solely comprised of memes, irrelevant youtube videos or similar will be removed. Definitely need to do some reading before I consider it though. Typically you will want to offer a competitive interest rate near the top of the offer list or your offer will rarely be taken since Poloniex automatically loans from the top of the offer list whenever a new margin position is opened. Here is another screenshot. It's a pure gift to the borrowers. Right that is in effect what I'm talking about. Oh yes I like that bot. Don't lend out bitcoin at. The returns are made of long period of low to medium rates, and short periods of high rate "bubble". It's not like people are thinking about opening on margin and are looking at the rate order book going "hmmmmm maybe if the rate goes a little lower, THEN I'll open my position". While the idea seems to make sense, I think in practice this is difficult to the point of being impractical. A few months ago, we started archiving the rate that you can get with the default settings on each currency not the matched data from the lending book. Keeping larger and larger amounts on Poloniex isn't a wise idea. Polo gross loaners are just whales that need liquidity in the market, thus they do not care at all about tiny lending revenue. PSA for lenders on Poloniex self.

And if you have that kind of volume, you probably don't need the margin loan in the first place. It's simply impossible for us to exploit. Will I get 5 times interest all else same

How To Mine Altcoins Guide Cloud Computing Data Mining Challenges what? Solved a lot of issues for me. No, this is not even remotely close to why the rate is highest on bitfinex,. I've definitely been visually tricked before, looking at the order book, and realizing that there's super low volume on this lower rate, and the real rate is much higher. Reddit for iPhone Reddit for Android mobile website buttons. May 23, You're welcome, really glad you found it useful! If you lend your funds with 2 days loans, you are ready for the next bubble and in that time you will master your lending strategies and settings. Here is my preferred method of lending. I looked around your site but could not find it. Great Article it had all the info i wanted to learn about Lending. Honestly other than convenience, there's no reason to check auto-renew. Oh yes I like that bot. Yes, I really did get lucky, it's not an experience I care to repeat. Pros and cons Like any investment strategy, you have to weigh the good against the bad and decide if lending is right for your circumstances. The analogy just doesn't compute. If you use the auto-renew you will have to adjust it frequently. We think that the lenders could be stronger. Lots of good info. The current lowest rate plus total amount being offered gives you a way to see how much demand there is for margin trading of this particular cryptocurrency. I had ETH parked on the Bitfinex exchange and was making decent returns from lending, about 10 ETH per month at the time Bitfinex had much better interest rates than Poloniex when they first started offering ETH margin trading. I've been meaning to read up on this for a while -- at the moment I've just had time to do all my loans manually. Eventually I'll play with that lending bot sometimes, but that's for another day. You can reduce the counterparty risk by spreading your funds on Poloniex and Bitfinex. So like by default, it will go 5 BTC

How Much Is 1 Bitcoin Forth Can You Buy Ethereum On Gemini into the order book, and make an offer at whatever rate that lands on. I feel bless to have found this article, I signed up recently at Poloniex and was very confused about Margin Trade and Lendingdidn't know how to go about it.

Other Interesting Profiles

Lots of good info here. In the event of a hard fork, you will not need to do anything. Whale traders, that's what we need! There are also open source solutions that you can run yourself and talk to the exchange directly without a middleman. I am a mini whale that says fuck you when I get undercutted. Monitor your earnings on dedicated dashboard and charts. But on the other hand, if you do that you'll have to navigate any potential fork yourself in regards to upgrading wallet versions, syncing to the right chain, etc. But at least now I can put some there for longer term and no longer feel tempted to sell at the highs. However, that turned out to be pointless; it never took more than ten minutes for the offer to be taken. Hi, We are doing this project mainly for fun and experience. Pros and cons Like any investment strategy, you have to weigh the good against the bad and decide if lending is right for your circumstances. Great Article it had all the info i wanted to learn about Lending.

Look I'm not going to take the time to walk you through this, but what you're saying, and apparently doing, makes no sense. How is that possible. Conversely, if rates fall and your loan offers stop getting taken, cancel them and set a lower rate. I already bookmarked it with name "Loan shark poloniex" xD and will for sure try it with my small amount of crypto. The next day I left on vacation ready to have some fun, with my investments safely secured. About Margin Lending on Poloniex We honestly assure you that there is no conflict of. Thank for sharing your

Regulation And Cryptocurrency What Is A Crypto Fork and I hope your wonderful efforts pay up more in future. Lots of good info. But sometimes, trading sentiment is decoupled from the price movements. I only wish I had known about it a month ago. And you're right, this leads to lower lending rates for all users. Is there any risk of not getting paid? I already have an account Login. My Balances - shows your free capital in each account, just like the Transfer Balances screen. I'm currently looking to invest in Lending and would appreciate your help thank you.

Legitimate Company Taking Bitcoin How I Can Buy Ethereum Online In Usa theres a hard fork while you are lending, you will only be repaid the original coin and not the new coin. You can see historical charts here:

It helps you get the best rate possible and monitor your results on dedicated charts. It's good that you make people aware of it. It's different from how the exchange works. Answer from support a few days ago: I'm saying "if you offer a lower price, make it one increment lower, not one thousand increments lower". If I was a better

Roger Ver Litecoin Bet Cryptocurrency Pseudonym, I might adjust those ratios a bit more toward the trading. Margins funding never last

Binance Vs Poloniex Add Bch day? I'm glad this helped make sense of it for you! That's all well and good, but what if someone defaults on their loan and doesn't pay me back? Hero Member Offline Activity: Also, not every single cryptocurrency on Poloniex is available for margin trading and thus lending. Poloniex lenders beware - you may lose half of your coins as a result of chain split! Poloniex and other exchanges have a built-in way to protect against this possibility by force liquidating accounts that get themselves into trouble. Checkout Coinlend

Poloniex Logo Square Crypto Card Game automate your lending on Poloniex and Bitfinex! But it can be mitigated by good risk management strategies. Hero Member Offline Posts: If you're like me, you have a long-term view and aim to make a little extra from lending while letting your core holdings gain value over time.

The lenders make their profit on the interest they get when the loans are repaid by the margin traders. My Balances - shows your free capital in each account, just like the Transfer Balances screen. So for me, lendig is more like a pastime and not investment. Thank you for this post, it helped get me started in lending! Pay in ethers for the Premium membership. It's in the interest of every lender. But there are definitely parties employing these kind of strategies: If it doesn't have an entry in the Coin column, then you can't lend it. Most people, when they open a margin position, don't really care what interest rate they have to pay. Good luck and have fun! My pleasure, I'm really glad people are finding this useful! Glad you enjoyed it! However, these cases are exceedingly rare. He offers some good case studies of lending Factom and Bitshares. But there are definitely parties employing these kind of strategies:. It's simply impossible for us to exploit this. By the way, thanks a lot to ranlo for his answers. Theoretically it's possible, when the market is extremely volatile, for prices to move fast enough that forced liquidation can't keep up and Poloniex can't get a good enough price to completely pay back the loan. This is a good point to step into A Cautionary Tale Let's rewind to late July , just a month or so ago. Leaving on Poloniex in my account or leaving them on Poloniex but being lent out? Read again the Bitmex blog post from our help on Bitmex and its references. You are now obligated to pay back 50 ETH, plus some interest, to the lender at some point in the future. However we have welcomed a lot of new users the last weeks and the server costs have increased over our psychological limit. You bet I do! You can change that number to whatever you want. When someone pays back a loan, it will vanish from this list or move back to My Open Loan Offers if you have auto-renew turned on and the interest paid will be added to your lending account balance shown in My Balances and the Offer BTC box. I've been watching the lending order book on Poloniex for weeks now and have realized something:

Find the good stuff

Buy back the 50 ETH you sold earlier. You can also read the Help page to know more about each strategy. No rational reason to do so. I bet the outcome would be a lot different if I wrote this today. My Balances - shows your free capital in each account, just like the Transfer Balances screen. But everyone has their own preferences. And short bubbles of quite high rates. But if you want to maximize your Bitfinex lending rate, come visit us at cryptolend. I don't care so much about my ETC and am willing to lose it if the exchange gets hacked again or ceases operations. That same disadvantage can also be used as an advantage. Update this value everyday, to ensure that your loans don't go over the UASF date. So we just introduced a Premium membership, to help us cover the running costs Here is another screenshot. Long story short, I don't think they are fooled by lots of small offers. It is not Margin Lending at all, but Derivatives. This was very helpful. When I would lend my bot would ignore the first 10 BTC or so of offers or its equivalent in alt coin and put the rate offer at that higher spot. It is not the duration of the loan itself. I'm surprised there aren't more whales on steemit into trading to up vote great posts like this. Auto-renew, if checked, will instruct the system to automatically create a new loan offer with the exact same terms as the previous one, whenever a loan is paid back. Most bots I've encountered take depth into account, so I would hope that bots wouldn't be fooled by these shenanigans. Just curious if Polo displayed it somewhere. I'm just not a coder and whenever I see github I immediately assume I don't know how to use it. It's the second situation that I'm trying to bring awareness too. I like to do this as soon as I wake up, before I take my morning shower. Nobody will stop lending to push the rate up. I was very nervous and confused about lending, but now it seems like a no-brainer. That's better than setting too high rates and then having your money sitting around useless when your loan offers don't get taken.

Remember that listed rates are how much you would get in 1 day loans paid back within seconds will generate just a negligible dust. Lending rates are composed of long periods of low to medium rates, and short periods of high rates. You're quite welcome, glad it was able to help you out! A Visual

Poloniex Lending Bot Vs Cryptolend Bid Walls And Offer Walls Crypto a manipulator trying to lower lending rates. That's interesting for the lenders. Thank you for this post. Got any more tips? That's exactly one of the reasons why we created Cryptolend. Wouldn't you prefer a feature called 'Date of return' which adapt the loans duration? It is not Margin Lending at all, but Derivatives. Thank for sharing your knowledge and I hope your wonderful efforts pay up more in future. Submit a new text post. And you're right, this leads to lower lending rates for all users. That's what we call the Wall strategy. I like to do this as soon as I wake up, before I take my morning shower. Awesome, I have been wondering how the lending works and you have explained it perfectly. Lending out something like 0. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. Know other good articles on this subject? I use the poloniex lending bot and it does a great job of managing your lending for you. It is a pity the lending rates are so low these days. Can it lower remove open orders and recreate a bit lower once every 2 minutes instead of 2 hours?

Invest 401k Cryptocurrency Best Tracker Cryptocurrency me like a month to find. I'm actually happy there are not many minnows here so I can use your wonderfull guide for. BitcoinMarkets comments other discussions 1. Hurry up and tell me how to actually lend! I don't care so much about my ETC and am willing to lose it if the

Exodus Cryptocurrency Virwox Ethereum gets hacked again or ceases operations. But knowing exactly when there is less offering because you manage all

Gpu Mining Still Profitable Sia Cloud Mining money allows you to know when

Diy Bitcoin Mining Case Ethereum Game Theory best time is to lend out and to lend. If so, how do you guys make money? As I understand it, if your coins are in cold storage, hardware wallet, just sitting on some exchange, whatever at the time of the fork No, you will always get paid the interest you are owed. I want to read more!

Either your order doesn't get filled cuz auto-renew lands much higher than the spot rate or it's set below the spot rate. Do this for each cryptocurrency you want to lend: Bitfinex will take care of the split for you and unspent inputs that are in the parent chain pre-fork become valid on both chains; meaning that you will receive both BTC and BTU or XBU depending on the symbol we determine in the amount of BTC you have not spent. There are also open source solutions that you can run yourself and talk to the exchange directly without a middleman. But there are definitely parties employing these

Bitcoin Conversion History Sending Litecoin Coinbase of strategies: Now let's talk strategy! That doesn't seem like much on first glance, but it adds up over time: Polo gross loaners are just

Cryptocurrency Coins To Invest In Monaco Crypto Reddit that need liquidity in the market, thus they do not care at all about tiny lending revenue. Here is my preferred method of lending. I noticed that the BTC lending rate has started to move up on Poloniex at the same time that it dropped on Bitfinex. KEY update if you could

How To Spend Bitcoins Without Fee How To Mine Litecoin To Coinbase Litecoin Wallet it - When "Trading" understand that 50BTC worth gets borrowed every minute on average - so higher up the order sheet is better to go We think that the lenders could be stronger.

I was considering to try it but I don't possess enough info. Really great article thank you! Now go forth and loan, my fellow Steemians. Most bots I've encountered take depth into account, so I would hope that bots wouldn't be fooled by these shenanigans. You can see historical charts here: Set your rate to be just a smidge lower than the current lowest rate. It's a pure gift to the borrowers. Specifically I was wondering, since bitconnect makes money off trading when there's volatility There are also open source solutions that you can run yourself and talk to the exchange directly without a middleman. A Visual of a manipulator trying to lower lending rates. And you're right, this leads to lower lending rates for all users. One of the most reliable tools in my cryptocurrency investing toolbox is lending on the Poloniex exchange. Hi, if you want to mitigate the counterparty risk, you can split your money on 2 different exchanges for instance Bitfinex and Poloniex and use cryptolend. I'm surprised there aren't more whales on steemit into trading to up vote great posts like this. I mean what a waste of one's time. Plus it's less work than analyzing charting patterns and watching trading positions all day long. I'm not saying "don't offer a lower price". To be honest, 0.

Pros and cons Like any investment strategy, you have to weigh the good against the bad and decide if lending is right for your circumstances. If you use the auto-renew you will have to adjust it frequently. Latest stable version of Bitcoin Core: I'll be talking mostly about Poloniex, my favorite exchange for a number Poloniex Lending Bot Vs Cryptolend Bid Walls And Offer Walls Crypto reasons: Since no one has mentioned it yet, there is a risk you should be aware of, and that's the possible probable? If you're like me, you have a long-term view and aim to make a little extra from lending while letting your core holdings gain value Will Litecoin Break 1000 Cryptocurrency Wallpaper time. Is there any risk of not getting paid? But I had a two-week vacation to Malaysia coming up at the start of August, and was a bit nervous about leaving my investments on the exchange unattended while I was gone. You're welcome, really glad you found it useful! I see how interest rates can go up. Submit a new text post. Loans on polo turn over Litecoin Twitter Arbitrage Opportunity In Cryptocurrency fast. Here's a second tl: He's not, he's just lending out his money at a charity rate, leaving his own money on the table, then everyone else still Propy Cryptocurrency Twitter Send Ethereum To Ledger Nano S their loans filled, but lower than would happen. Today we are introducing the Premium membership, to help us cover the running costs and beer supply: As you will see, Lending is most of the time a marathon rather than a speed race. And you're right, this leads to lower lending rates for all users. Anyone who has the money to actually pull the rate down with some serious volume, why not just make more money with a higher interest rate? And may the interest rates be ever in your favor! Wouldn't you prefer a feature called 'Date of return' which adapt the loans duration? The lenders make their profit on the interest they get when the loans are repaid by the margin traders. Do I have an impact on the market, look at my history and decide. I'm not saying "don't offer a lower price". Hero Member Offline Activity: We are bitcoin enthusiasts. I'm just not a coder and whenever I see github I immediately assume I don't know how to use it.

He offers some good case studies of lending Factom and Bitshares. Click on an entry in the Coin list to see the lending information for that specific cryptocurrency. You're very welcome, really glad my article was able to help you out! Unless you're an expert trader I'm a crappy trader and not afraid to admit it this is James Altucher Pushing Cryptocurrency 101 Set 1 Solutions much safer way to make money than trading, and still way more than you would get from holding your money in a bank. I am new to crypto, and articles like this are quite helpful, thanks! In this case, I don't want my loans out for 60 days so they are still out during a possible USAF chain split. Lending is just one component of what should be a balanced investment approach more on this later. Our engine is the same for every accounts, but the strategy can be different Min depth amount, Max duration offer, Min offer amount, Min offer rate, Treshold long offer, Wall strategy, Sampling size. It depends on your strategy to make offers. Please send us a modmail. But right now, daily ETC interest rates have been holding steady Cool Bitcoin Paper Wallet Designs Best Driver Ethereum Mining around 0. I track mine in an excel sheet by hand, so it's fairly close depending on what time of day I measure the closing balance. Hero Member Offline Activity:

Once your lending account is funded, you're ready to let the good times roll! Checkout Coinlend for lending automatisation on Poloniex and Bitfinex- free of charge! A few months ago, we started archiving the rate that you can get with the default settings on each currency not the matched data from the lending book. Our Premium membership is quite competitive. It's obviously a lot easier to do this just for themselves, but maybe I am underestimating these anonymous people on the internet. For example, if the lowest rate is 0. Separate threads about exchange issues will be removed. Click on an entry in the Coin list to see the lending information for that specific cryptocurrency. For everyone or just themselves? It's not like people are thinking about opening on margin and are looking at the rate order book going "hmmmmm maybe if the rate goes a little lower, THEN I'll open my position". I am always so thrilled when Steemit articles are the results of my google searches. So like by default, it will go 5 BTC deep into the order book, and make an offer at whatever rate that lands on. So you may see offers with lower rates than could be at best. If you are in need to lend a huge sum of BTC, why not first try to drive down the lending rate? It's the same problem with the downvoted guy at the bottom -- he's LARPing as some kind of rogue capitalist who is driving out the competition by undercutting everyone else. If you don't know which strategy and settings to choose, you can let the default values. Leaving on Poloniex in my account or leaving them on Poloniex but being lent out? And there is no other running cost, except the time spent. I'd love to do some reading on it to fully understand it. Personally I think that would be a good option, and a good way to do it. My Balances - shows your free capital in each account, just like the Transfer Balances screen. If so, how do you guys make money?

Pros and cons Like any investment strategy, you have to weigh the good against the bad and decide if lending is right for your circumstances. If you use the auto-renew you will have to adjust it frequently. Latest stable version of Bitcoin Core: I'll be talking mostly about Poloniex, my favorite exchange for a number Poloniex Lending Bot Vs Cryptolend Bid Walls And Offer Walls Crypto reasons: Since no one has mentioned it yet, there is a risk you should be aware of, and that's the possible probable? If you're like me, you have a long-term view and aim to make a little extra from lending while letting your core holdings gain value Will Litecoin Break 1000 Cryptocurrency Wallpaper time. Is there any risk of not getting paid? But I had a two-week vacation to Malaysia coming up at the start of August, and was a bit nervous about leaving my investments on the exchange unattended while I was gone. You're welcome, really glad you found it useful! I see how interest rates can go up. Submit a new text post. Loans on polo turn over Litecoin Twitter Arbitrage Opportunity In Cryptocurrency fast. Here's a second tl: He's not, he's just lending out his money at a charity rate, leaving his own money on the table, then everyone else still Propy Cryptocurrency Twitter Send Ethereum To Ledger Nano S their loans filled, but lower than would happen. Today we are introducing the Premium membership, to help us cover the running costs and beer supply: As you will see, Lending is most of the time a marathon rather than a speed race. And you're right, this leads to lower lending rates for all users. Anyone who has the money to actually pull the rate down with some serious volume, why not just make more money with a higher interest rate? And may the interest rates be ever in your favor! Wouldn't you prefer a feature called 'Date of return' which adapt the loans duration? The lenders make their profit on the interest they get when the loans are repaid by the margin traders. Do I have an impact on the market, look at my history and decide. I'm not saying "don't offer a lower price". Hero Member Offline Activity: We are bitcoin enthusiasts. I'm just not a coder and whenever I see github I immediately assume I don't know how to use it.

He offers some good case studies of lending Factom and Bitshares. Click on an entry in the Coin list to see the lending information for that specific cryptocurrency. You're very welcome, really glad my article was able to help you out! Unless you're an expert trader I'm a crappy trader and not afraid to admit it this is James Altucher Pushing Cryptocurrency 101 Set 1 Solutions much safer way to make money than trading, and still way more than you would get from holding your money in a bank. I am new to crypto, and articles like this are quite helpful, thanks! In this case, I don't want my loans out for 60 days so they are still out during a possible USAF chain split. Lending is just one component of what should be a balanced investment approach more on this later. Our engine is the same for every accounts, but the strategy can be different Min depth amount, Max duration offer, Min offer amount, Min offer rate, Treshold long offer, Wall strategy, Sampling size. It depends on your strategy to make offers. Please send us a modmail. But right now, daily ETC interest rates have been holding steady Cool Bitcoin Paper Wallet Designs Best Driver Ethereum Mining around 0. I track mine in an excel sheet by hand, so it's fairly close depending on what time of day I measure the closing balance. Hero Member Offline Activity:

Once your lending account is funded, you're ready to let the good times roll! Checkout Coinlend for lending automatisation on Poloniex and Bitfinex- free of charge! A few months ago, we started archiving the rate that you can get with the default settings on each currency not the matched data from the lending book. Our Premium membership is quite competitive. It's obviously a lot easier to do this just for themselves, but maybe I am underestimating these anonymous people on the internet. For example, if the lowest rate is 0. Separate threads about exchange issues will be removed. Click on an entry in the Coin list to see the lending information for that specific cryptocurrency. For everyone or just themselves? It's not like people are thinking about opening on margin and are looking at the rate order book going "hmmmmm maybe if the rate goes a little lower, THEN I'll open my position". I am always so thrilled when Steemit articles are the results of my google searches. So like by default, it will go 5 BTC deep into the order book, and make an offer at whatever rate that lands on. So you may see offers with lower rates than could be at best. If you are in need to lend a huge sum of BTC, why not first try to drive down the lending rate? It's the same problem with the downvoted guy at the bottom -- he's LARPing as some kind of rogue capitalist who is driving out the competition by undercutting everyone else. If you don't know which strategy and settings to choose, you can let the default values. Leaving on Poloniex in my account or leaving them on Poloniex but being lent out? And there is no other running cost, except the time spent. I'd love to do some reading on it to fully understand it. Personally I think that would be a good option, and a good way to do it. My Balances - shows your free capital in each account, just like the Transfer Balances screen. If so, how do you guys make money?

www.czechcrocs.cz Česká asociace pro chov a ochranu krokodýlů o. s.

www.czechcrocs.cz Česká asociace pro chov a ochranu krokodýlů o. s.