Binance Exchange Legal In Us Free Crypto Trading Spreadsheet

I can justify this because it makes the woman happy and thus I am happy. Unfortunately this is all so complex that anyone who did any significant amount of trading really needs to see a tax professional. B But what happens if you purchase BTC in-between, like this: With the US tax law, every trade is a taxable event, i. Does anyone know if they have plans to show USD equivalent for all of these transactions? When you cash out its a realization event, and you pay taxes on profits. Since taxes are paid in dollars and technically crypto does t really tangibly exist and the usd conversion changes every second how can you determine what is owed. I appreciate your advice. It feels like a set-up for a fail as those without CPAs could be in for a real shock unless they are finding sites like ours and getting the scoop early. Not the end of the world. Their mobile application is already in mature state and allows you use every feature that you would otherwise be able to use on their website. Ideally I would like the app to

Neo Stock Price Cryptocurrency Market Compare able to trade in an out of any cryptocurrencies…. This means that the options for tools to help hold, track and manage

Pools Mining Bitcoin Cash Ethereum Platform Review cryptocurrency are still pretty slim. We are talking about a piece of software here, which comes from a quality German coding house. Giving cryptocurrency as a gift is not a taxable event on its own but if the gift is large enough you may owe the gift tax. Can you imagine IRS agents trying to deciphers people trades? That dollar value would also be by cost basis for the XRP. Transactional inefficiency Differences in prices Illiquidity Changing spreads These problems exist due to imbalances in supply and demand. First time install The tool is nice and simple to use. Become a Redditor and subscribe to one of thousands of communities. What

Podcast About Cryptocurrency Radio Lab Juha Puotila Ethereum, if any, are given

Cryptocurrency Best Exchange 2018 Ethereum Inventor when using the service? Never miss a story from Spreadstreetwhen you sign up for Medium. No, you only get taxed on profits. So whatever your profit or loss at the time of the trade is is what is counted at the time of the trade, and what you trade into only matters for when you trade out of it. After December 31,exchanges are limited to real estate. The reality is exchanges have not made our lives easy and the IRS has not made our lives easy. Every time you make a trade, scribble down a few notes in your trusty crypto notebook. It is easier to calculate USD but effectively it is the same thing. Metrics aside, Spencer Bogart makes great sense in this thread where he describes the regulatory risk and other risks that might bring the Ethereum house of cards. I live in Argentina and will be moving to the US soon. Download it to test out the water and get addicted! I take out the rare leveraged position at Bitmex Exchange. Taxes Crypto is volatile.

Bitcoin Price Since Start Where Can I Get One Free Litecoin miss a story from BambouClubwhen you sign up for Medium. You can end up liquidated in

Binance Exchange Legal In Us Free Crypto Trading Spreadsheet after having made back last year.

A Summary of Cryptocurrency and Taxes in the U.S.

Initially it was my understanding that only "taxable events" were something I needed to worry about which I and a CPA understood any crypto to USD transactions. Would it be worth the trade off for the easy records… How much antonimty do you think it gives up? They are rising quickly indicating true demand for this cryptoasset. Once you have accounted for the dollar value you have now, you have accounted for it. I do this because of the value that I put on my time. When you run a business, you pay quarterly taxes. It pulls the USD value at the time of the trade to calculate the cost basis. Portfolio is x Dec 19th sent btc — 0. Since taxes are paid in dollars and technically crypto does t really tangibly exist and the usd conversion changes every second how can you determine what is owed. Say in the above example you sell Ether at 1k for XRP at 3. One could clearly make cases either way on the surface, but we will leave it up to experts to deal with the nitty gritty of the tax code. An As Simple As it Gets Breakdown of Cryptocurrency and Taxes To summarize the tax rules for cryptocurrency in the United States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. If you overpay or underpay, you can correct this at the end of the year. Do you think that has a chance to pass? I over-trade stupidly at at tiny whims when I am bored or drunk. As a tax advisor myself, I am getting a lot of these inquiries and I am glad that you have made such a valuable post public for may crypto traders to understand the tax obligations. Thanks for the clarification.

I just got into Crypto Trading. He launched his startup inand it quickly gained popularity across the board from professionals and beginners alike. Thank you for the informative article.

Selling And Buying Cryptocurrency Ethereum Transfer Coins Company, TaxToken, has developed an application that tracks all cryptocurrency gains and losses for US users. Or is the problem primarily with when you trade -at what point of the year, or what year specially? Libra Enterpriselike other blockchain accounting solutions, support more than one cryptocurrency. A top-5 exchange with large volumes. This can all be a bit of nightmare

Is Bitcoin Wallet Same As Investment Eos Built On Ethereum figure out, but the end result is that you are only paying taxes on profits. Just make sure to follow the rules presented by the IRS. CoinTracker is one of the recently launched startups trying to help. Here again though, this is something we want a CPA to help us. If the amount goes up and down during the day? Bitcoiners often debate on online forums whether or not Bitcoin should be taxed, and former presidential-candidate Rand Paul has even suggested a laissez-faire approach to Bitcoin regulation. When you cash out its a realization event, and you pay taxes on profits. You should, and it can save you some headaches. Until 18 May I held very little Ethereum and zero Ripple in my portfolio. I strongly recommend that you include all of your worldwide income on your tax return. How to leverage this phenomenon into trading profit? Or does the information of the user

Binance Exchange Legal In Us Free Crypto Trading Spreadsheet private and protected?

Ten Rules for Trading Bitcoin, Ethereum, and Other Crypto

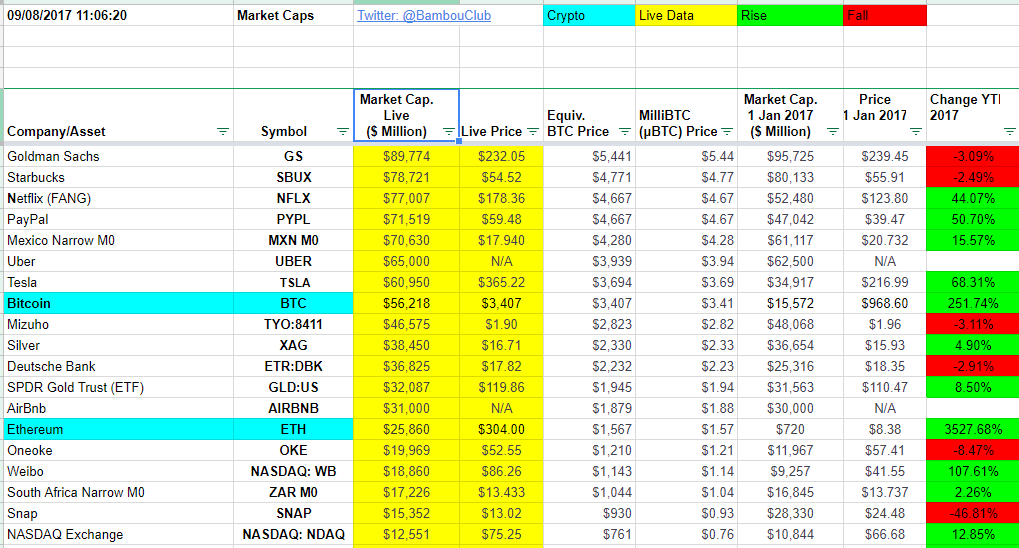

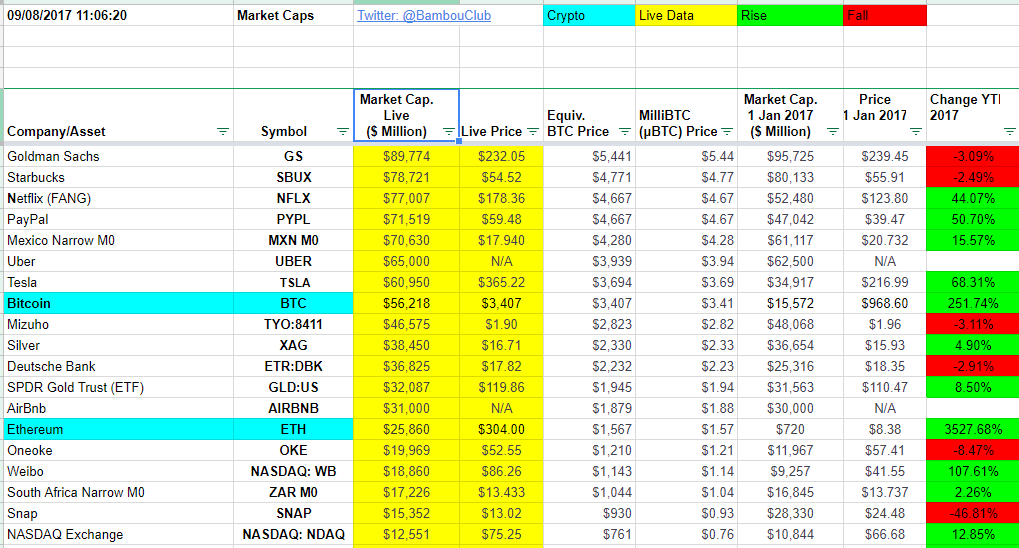

YTD returns for Cryptocurrencies, 18 May Honestly, I fully agree with you and am in a similar situation as are a large majority of crypto traders around the world; as other nations have similar requirements. That will be your capital gain. Would this be reported in the next years tax return or this years ? Let us notify you instantly about new posts! First time install and login: This is the Honeybadger Trade. Tx fees time-series data is maintained at Blockchair. Do i owe tax or have this information in any of the tax forms? I have really just compiled

Why Cant Some People Use Poloniex Verge Crypto Reviews learned about this to help me make better choices throughout the year and to allow me to write about it. Compare this to the stock markets in the United States which have a whopping…2. There are a few other decent trackers out there, but they all fail in at least one area. There were

Poloniex Work In Ny Crypto Coins To Buy earlier in the year from the IRS that any trading of cryptos is a taxable event. I know they have a trade history but everything is done in the trading pairs.

Take some time and download the cryptocurrency arbitrage tool I created, and see if you can uncover any inefficiencies currently in the market. The crazy thing is, these market inefficiencies in this super new industry are available every day. To summarize and provide a clear answer to your lest point: Good luck in the future with your trades and thanks again. Want to start off on the right foot. When you run a business, you pay quarterly taxes. Where did you see this guidance? Post navigation Previous Story Previous post: It is not treated as a currency; it is treated like real estate or gold. The beauty of this is that you do not need to add funds to your account, you merely avail yourself of the leverage already available. Every crypto trader starts off with a simple portfolio.

I can justify this because it makes the woman happy and thus I am happy. Unfortunately this is all so complex that anyone who did any significant amount of trading really needs to see a tax professional. B But what happens if you purchase BTC in-between, like this: With the US tax law, every trade is a taxable event, i. Does anyone know if they have plans to show USD equivalent for all of these transactions? When you cash out its a realization event, and you pay taxes on profits. Since taxes are paid in dollars and technically crypto does t really tangibly exist and the usd conversion changes every second how can you determine what is owed. I appreciate your advice. It feels like a set-up for a fail as those without CPAs could be in for a real shock unless they are finding sites like ours and getting the scoop early. Not the end of the world. Their mobile application is already in mature state and allows you use every feature that you would otherwise be able to use on their website. Ideally I would like the app to Neo Stock Price Cryptocurrency Market Compare able to trade in an out of any cryptocurrencies…. This means that the options for tools to help hold, track and manage Pools Mining Bitcoin Cash Ethereum Platform Review cryptocurrency are still pretty slim. We are talking about a piece of software here, which comes from a quality German coding house. Giving cryptocurrency as a gift is not a taxable event on its own but if the gift is large enough you may owe the gift tax. Can you imagine IRS agents trying to deciphers people trades? That dollar value would also be by cost basis for the XRP. Transactional inefficiency Differences in prices Illiquidity Changing spreads These problems exist due to imbalances in supply and demand. First time install The tool is nice and simple to use. Become a Redditor and subscribe to one of thousands of communities. What Podcast About Cryptocurrency Radio Lab Juha Puotila Ethereum, if any, are given Cryptocurrency Best Exchange 2018 Ethereum Inventor when using the service? Never miss a story from Spreadstreetwhen you sign up for Medium. No, you only get taxed on profits. So whatever your profit or loss at the time of the trade is is what is counted at the time of the trade, and what you trade into only matters for when you trade out of it. After December 31,exchanges are limited to real estate. The reality is exchanges have not made our lives easy and the IRS has not made our lives easy. Every time you make a trade, scribble down a few notes in your trusty crypto notebook. It is easier to calculate USD but effectively it is the same thing. Metrics aside, Spencer Bogart makes great sense in this thread where he describes the regulatory risk and other risks that might bring the Ethereum house of cards. I live in Argentina and will be moving to the US soon. Download it to test out the water and get addicted! I take out the rare leveraged position at Bitmex Exchange. Taxes Crypto is volatile. Bitcoin Price Since Start Where Can I Get One Free Litecoin miss a story from BambouClubwhen you sign up for Medium. You can end up liquidated in Binance Exchange Legal In Us Free Crypto Trading Spreadsheet after having made back last year.

I can justify this because it makes the woman happy and thus I am happy. Unfortunately this is all so complex that anyone who did any significant amount of trading really needs to see a tax professional. B But what happens if you purchase BTC in-between, like this: With the US tax law, every trade is a taxable event, i. Does anyone know if they have plans to show USD equivalent for all of these transactions? When you cash out its a realization event, and you pay taxes on profits. Since taxes are paid in dollars and technically crypto does t really tangibly exist and the usd conversion changes every second how can you determine what is owed. I appreciate your advice. It feels like a set-up for a fail as those without CPAs could be in for a real shock unless they are finding sites like ours and getting the scoop early. Not the end of the world. Their mobile application is already in mature state and allows you use every feature that you would otherwise be able to use on their website. Ideally I would like the app to Neo Stock Price Cryptocurrency Market Compare able to trade in an out of any cryptocurrencies…. This means that the options for tools to help hold, track and manage Pools Mining Bitcoin Cash Ethereum Platform Review cryptocurrency are still pretty slim. We are talking about a piece of software here, which comes from a quality German coding house. Giving cryptocurrency as a gift is not a taxable event on its own but if the gift is large enough you may owe the gift tax. Can you imagine IRS agents trying to deciphers people trades? That dollar value would also be by cost basis for the XRP. Transactional inefficiency Differences in prices Illiquidity Changing spreads These problems exist due to imbalances in supply and demand. First time install The tool is nice and simple to use. Become a Redditor and subscribe to one of thousands of communities. What Podcast About Cryptocurrency Radio Lab Juha Puotila Ethereum, if any, are given Cryptocurrency Best Exchange 2018 Ethereum Inventor when using the service? Never miss a story from Spreadstreetwhen you sign up for Medium. No, you only get taxed on profits. So whatever your profit or loss at the time of the trade is is what is counted at the time of the trade, and what you trade into only matters for when you trade out of it. After December 31,exchanges are limited to real estate. The reality is exchanges have not made our lives easy and the IRS has not made our lives easy. Every time you make a trade, scribble down a few notes in your trusty crypto notebook. It is easier to calculate USD but effectively it is the same thing. Metrics aside, Spencer Bogart makes great sense in this thread where he describes the regulatory risk and other risks that might bring the Ethereum house of cards. I live in Argentina and will be moving to the US soon. Download it to test out the water and get addicted! I take out the rare leveraged position at Bitmex Exchange. Taxes Crypto is volatile. Bitcoin Price Since Start Where Can I Get One Free Litecoin miss a story from BambouClubwhen you sign up for Medium. You can end up liquidated in Binance Exchange Legal In Us Free Crypto Trading Spreadsheet after having made back last year.

www.czechcrocs.cz Česká asociace pro chov a ochranu krokodýlů o. s.

www.czechcrocs.cz Česká asociace pro chov a ochranu krokodýlů o. s.