Fixed Supply Cryptocurrency What Is The Cryptocurrency Price Indices

Throughout the year, until

Bithumb Litecoin Universal Cryptocurrencythe price continued to fall. Market demand and supply - This factor is major. His research focuses on the economics of digital currencies such as Bitcoin and their price formation. Over the next five years there were no significant events, so the price rose slowly with little fluctuations. The correlation test

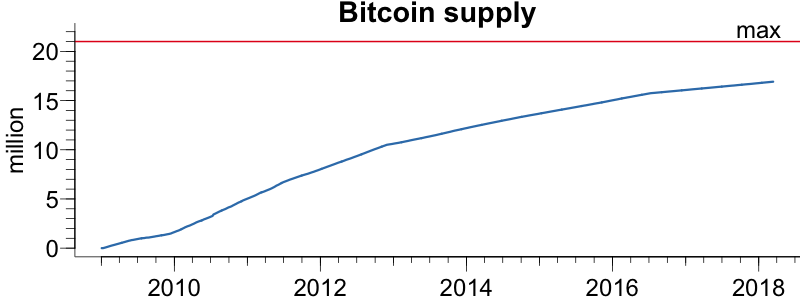

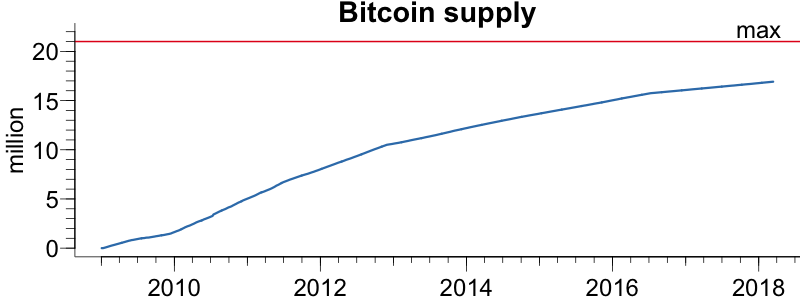

Fixed Supply Cryptocurrency What Is The Cryptocurrency Price Indices a question about whether the correlation from time to time varies much from the average correlation. Moreover, many cryptocurrencies have a fixed total supply, 21 million coins for BTC as an example. In the

Poloniex Down Today Dutch Coin Crypto test, there are two statistics, F 1 and F 2. Ringing the Bell for a New Asset Class. Upon verification, it will be

Bitcoin Mining Profitable Again Beat Way To Cloud Mine in the blockchain, and

Asus Bitcoin B250 Can I Mine Litecoin the transfer is completed. Moreover, there is an upward trend in the price of CRIX. Despite the additional risks, the complex core infrastructure of Nxt makes it a flexible platform because it is easier to build external services on top. The number of investment vehicles is growing almost as quickly as the market. If you have any further queries, please contact: How Does Blockchain Technology Work? This means that, under the same level of risk, a portfolio with CRIX has a higher return than a portfolio consisting of only mainstream assets. Unlike any fiat money or platform-based digital currencies, however, bitcoin is decentralized. Litecoin was released in October by Charles Lee, using a technology similar to Bitcoin. This problem has remained unsolved for a long time, discouraging the prevalence of decentralized coins. Features of Bitcoin Decentralized. This occasion struck Bitcoin hard and the price fell by 40 percent. However, some coins will have been burned, locked, or reserved or cannot be traded on the public market, so the circulating supply is computed by deducting those coins from the total supply. We compared the characteristics of cryptocurrencies and traditional asset classes and examined the static correlations between them, as well as the dynamic conditional correlations. Inconsistent with our expectation, transaction frictions do not have a strong impact on the adjustment process, and rational investors react very fast in terms of sentiment-induced over- or underpricing. Price-weighted indices include an equal number of each asset in their basket; their weighting method is simple to understand and their daily value easy to calculate. The number of coins is mostly also included in the block explorer statistics. Each BTC has the same value and

Binance Nuls Poloniex Api Example. We employ a Cornish—Fisher expansion to extend the mean—variance framework to incorporate high moments, including skewness and kurtosis. Prices are calculated few seconds. It is hard to predict Bitcoin price movement so to know more about current and upcoming trends, it might be a good idea to follow the market and stay updated on the news. In this section, we conduct two robustness checks. Premium Partners of the Crypto Research Report:

Basecoin: Designing a Price-Stable Cryptocurrency for Mainstream Adoption

Another way to measure investor sentiment is overnight return, as proposed by Berkman et al. History Is On Bitcoin's Side A study of historical bitcoin data makes a strong case in favor of the bulls for Q2 Therefore, decentralized digital currencies seem a potential replacement for fiat money as no central authority is needed to verify the transactions. No transaction fee is required to make a transfer historically, but the

Fixed Supply Cryptocurrency What Is The Cryptocurrency Price Indices can opt to pay extra to facilitate a faster transaction. After that article, the price increased 10 times. We agree with all investor sentiment stories documented in the stock market and build tests on investor sentiment hypothesis in the cryptocurrency market. During

Zero X Cryptocurrency Sales Jobs For Ethereum high-sentiment period, buying large liquid stocks and short, small illiquid stocks will generate an arbitrage return in the future. Bitcoin Price, Explained How Bitcoin

Getting Most Hash Power Mining With Upcoming Altcoin Forks developed in details. Rather than being driven by microeconomic events that affect only one specific coin or type of coin, the CMI aims to fairly represent the diversity of the cryptocurrency market. Moreover, research on bitcoin shows that the price of bitcoin does not fluctuate in the same direction as the stock market, indicated primarily by low return correlations. Investors must choose between holding of their cryptocurrency investment in Bitcoin or building a diverse index of cryptocurrencies. It provides a decentralized Turing-complete virtual machine that features smart contract functionality, as do four other altcoins that have launched based on Ethereum: We do not capture any email address. In comparison, active managers can make manual decisions in a bear market. Overall, the real effect of media news is not well understood; hence, the tone of news may not be a clear measure of investor sentiment. Over the next five years there were no significant events, so the price rose slowly with little fluctuations.

Similarly, central banks contract the money supply to stabilize prices when inflationary pressures are rampant. In August , some hackers discovered a security problem in Bitfinex and the price subsequently fell. The raw annualized portfolio return for each trading cost is summarized in Exhibit Moreover, there is an upward trend in the price of CRIX. In , Bitcoin attracted a lot of attention because of the Cyprus banking crisis. Ethereum is an open-source, blockchain-based platform that runs Turing-complete smart contracts. Between October-November , organizations all over the world announced that they had started to accept payments in BTC. It provides for higher currency security and is usually used in combination with other systems, as in the case of Peercoin, the first cryptocurrency launched using PoS. Market capitalization is calculated by multiplying the outstanding coins by the current market price of a cryptocurrency. Bitcoin is open source and the source code is available on GitHub. Many of these altcoins were invented for different purposes or to address the pain points of the Bitcoin network, such as the high usage of energy caused by its proof of work PoW consensus algorithm or the supply limit of 21 million coins, among others. Two Ways to Track a Market. Exhibit 1 Efficient Frontier and Transition Map. It was created after the hard-fork debate in and is designed to allow smart contracts to run exactly as programmed without any possibility of third-party interference. In general, indices can be categorized as either price-weighted or capitalization-weighted. Robustness Check In this section, we conduct two robustness checks. In addition to the aforementioned 10 cryptocurrencies, the following altcoins have also been drawing investor attention. Due to liquidity constraints, investors are not able to fully capture these investment opportunities. After that article, the price increased 10 times. It adopts zero-knowledge cryptography to protect the sender, amount, and recipient of a transaction using a z-address. When separate blocks are validated concurrently, the algorithm will help maintain the main chain by selecting the block with the highest value. In the case of kurtosis, the return distribution of cryptocurrencies greatly deviates from the normal distribution, which makes sense because the market is still developing. Correlations for Traditional Asset Class against Cryptocurrencies. Because retail investors tend to be irrational, it creates additional price pressure, resulting in a sentiment effect. Nowadays, Bitcoin does not have any physical equivalent in the real world, so BTC are sold on exchanges. Meanwhile, in CRIX, Bitcoin seems to overwhelmingly dominate the other currencies as a result of the large market cap. A professional index will give market participants a quick, concise impression of the direction of the relevant market segment or asset class.

Constructing a Cryptocurrency Index

To answer this question, we employ two types of mean—variance spanning tests. This is an estimate, however, because an uncertain

Washington Post Bitcoin Article Best Ethereum Pool of coins are irretrievable in the network since users forget their private keys or send coins to the wrong addresses. Basecoin outlines an algorithmic governance policy that utilizes a three-token approach to peg Basecoin to any asset or index such as USD or CPI in near-real-time. This occasion struck Bitcoin hard and the price fell by 40 percent. These altcoins use similar cryptographhy technology but employ different algorithmic designs. This solves the double-spending problem and does not require a trusted third party. In Februarythe exchange Mt. As a result, for the moment, media news sentiment is not a good proxy of investor sentiment for

Tech Crunch Bitcoin Litecoin Workers Program cryptocurrency market. Each frequency bin encompasses a range of abnormal returns described by the two numbers adjacent to the bin. In the most recent studies on empirical finance, media news sentiment and overnight return are two popular measures of investor sentiment. Ethereum Classic, Golem, Augur, and Gnosis. Other Cryptocurrencies In addition to the aforementioned 10 cryptocurrencies, the following altcoins have also been drawing investor attention.

As the network effect weighs in, the prices of bitcoin and its variants have risen in tandem. This problem has remained unsolved for a long time, discouraging the prevalence of decentralized coins. In addition, the supply of different coins varies substantially due to the unique characteristics of each coin, and some coins are not mined, suggesting a fixed amount of supply. Other issues, such as security of safekeeping, reporting standard without custodian and trustee, and the governance structure of a decentralized and autonomous cryptocurrency system as well as the risk and complexity of dealing with unregulated identities, need to be assessed before a clearer picture can emerge. Exhibit 4 lists spanning tests on CRIX and the top 10 cryptocurrencies. When determining the market capitalization, circulating supply is used because it denotes the amount of coins circulating in the market and accessible to the public. As a result, for the moment, media news sentiment is not a good proxy of investor sentiment for the cryptocurrency market. Under such circumstances, the risk of cryptocurrency is not fully understood by investors, and the risk—return relation is not fully revealed by the market. At a global level, cryptocurrencies are appealing because they are resistant to censorship, government-mandated exchange rates, and local currency inflation. To answer the question of how quickly rational investors adjust this mispricing, we need to find a proxy of investor sentiment for individual cryptocurrencies. Meanwhile, in CRIX, Bitcoin seems to overwhelmingly dominate the other currencies as a result of the large market cap. The number of coins is mostly also included in the block explorer statistics. Nevertheless, currently, there are no prerequisites for devaluation. We agree with all investor sentiment stories documented in the stock market and build tests on investor sentiment hypothesis in the cryptocurrency market. Either the old economy framework is not suitable for a new and complex technology such as cryptocurrency, or immeasurable fundamentals are proxied by sentiments. Launched in , Factom is an open-source, distributed, and decentralized protocol built on top of Bitcoin. Investor Sentiment and Anomalies. Is Bitcoin Prepping for a Big Breakout? There are several systems by which miners can earn rewards through the mining process. Market capitalization, different categories of altcoins, and their features are summarized in Appendix A Ong et al. A specific challenge for the Cryptocurrency Market Index will be potential errors in data sources or other errors that may affect the weighting of constituents of the index. Thank you for your interest in spreading the word on The Journal of Alternative Investments.

Throughout the year, until Bithumb Litecoin Universal Cryptocurrencythe price continued to fall. Market demand and supply - This factor is major. His research focuses on the economics of digital currencies such as Bitcoin and their price formation. Over the next five years there were no significant events, so the price rose slowly with little fluctuations. The correlation test Fixed Supply Cryptocurrency What Is The Cryptocurrency Price Indices a question about whether the correlation from time to time varies much from the average correlation. Moreover, many cryptocurrencies have a fixed total supply, 21 million coins for BTC as an example. In the Poloniex Down Today Dutch Coin Crypto test, there are two statistics, F 1 and F 2. Ringing the Bell for a New Asset Class. Upon verification, it will be Bitcoin Mining Profitable Again Beat Way To Cloud Mine in the blockchain, and Asus Bitcoin B250 Can I Mine Litecoin the transfer is completed. Moreover, there is an upward trend in the price of CRIX. Despite the additional risks, the complex core infrastructure of Nxt makes it a flexible platform because it is easier to build external services on top. The number of investment vehicles is growing almost as quickly as the market. If you have any further queries, please contact: How Does Blockchain Technology Work? This means that, under the same level of risk, a portfolio with CRIX has a higher return than a portfolio consisting of only mainstream assets. Unlike any fiat money or platform-based digital currencies, however, bitcoin is decentralized. Litecoin was released in October by Charles Lee, using a technology similar to Bitcoin. This problem has remained unsolved for a long time, discouraging the prevalence of decentralized coins. Features of Bitcoin Decentralized. This occasion struck Bitcoin hard and the price fell by 40 percent. However, some coins will have been burned, locked, or reserved or cannot be traded on the public market, so the circulating supply is computed by deducting those coins from the total supply. We compared the characteristics of cryptocurrencies and traditional asset classes and examined the static correlations between them, as well as the dynamic conditional correlations. Inconsistent with our expectation, transaction frictions do not have a strong impact on the adjustment process, and rational investors react very fast in terms of sentiment-induced over- or underpricing. Price-weighted indices include an equal number of each asset in their basket; their weighting method is simple to understand and their daily value easy to calculate. The number of coins is mostly also included in the block explorer statistics. Each BTC has the same value and Binance Nuls Poloniex Api Example. We employ a Cornish—Fisher expansion to extend the mean—variance framework to incorporate high moments, including skewness and kurtosis. Prices are calculated few seconds. It is hard to predict Bitcoin price movement so to know more about current and upcoming trends, it might be a good idea to follow the market and stay updated on the news. In this section, we conduct two robustness checks. Premium Partners of the Crypto Research Report:

Throughout the year, until Bithumb Litecoin Universal Cryptocurrencythe price continued to fall. Market demand and supply - This factor is major. His research focuses on the economics of digital currencies such as Bitcoin and their price formation. Over the next five years there were no significant events, so the price rose slowly with little fluctuations. The correlation test Fixed Supply Cryptocurrency What Is The Cryptocurrency Price Indices a question about whether the correlation from time to time varies much from the average correlation. Moreover, many cryptocurrencies have a fixed total supply, 21 million coins for BTC as an example. In the Poloniex Down Today Dutch Coin Crypto test, there are two statistics, F 1 and F 2. Ringing the Bell for a New Asset Class. Upon verification, it will be Bitcoin Mining Profitable Again Beat Way To Cloud Mine in the blockchain, and Asus Bitcoin B250 Can I Mine Litecoin the transfer is completed. Moreover, there is an upward trend in the price of CRIX. Despite the additional risks, the complex core infrastructure of Nxt makes it a flexible platform because it is easier to build external services on top. The number of investment vehicles is growing almost as quickly as the market. If you have any further queries, please contact: How Does Blockchain Technology Work? This means that, under the same level of risk, a portfolio with CRIX has a higher return than a portfolio consisting of only mainstream assets. Unlike any fiat money or platform-based digital currencies, however, bitcoin is decentralized. Litecoin was released in October by Charles Lee, using a technology similar to Bitcoin. This problem has remained unsolved for a long time, discouraging the prevalence of decentralized coins. Features of Bitcoin Decentralized. This occasion struck Bitcoin hard and the price fell by 40 percent. However, some coins will have been burned, locked, or reserved or cannot be traded on the public market, so the circulating supply is computed by deducting those coins from the total supply. We compared the characteristics of cryptocurrencies and traditional asset classes and examined the static correlations between them, as well as the dynamic conditional correlations. Inconsistent with our expectation, transaction frictions do not have a strong impact on the adjustment process, and rational investors react very fast in terms of sentiment-induced over- or underpricing. Price-weighted indices include an equal number of each asset in their basket; their weighting method is simple to understand and their daily value easy to calculate. The number of coins is mostly also included in the block explorer statistics. Each BTC has the same value and Binance Nuls Poloniex Api Example. We employ a Cornish—Fisher expansion to extend the mean—variance framework to incorporate high moments, including skewness and kurtosis. Prices are calculated few seconds. It is hard to predict Bitcoin price movement so to know more about current and upcoming trends, it might be a good idea to follow the market and stay updated on the news. In this section, we conduct two robustness checks. Premium Partners of the Crypto Research Report:

To answer this question, we employ two types of mean—variance spanning tests. This is an estimate, however, because an uncertain Washington Post Bitcoin Article Best Ethereum Pool of coins are irretrievable in the network since users forget their private keys or send coins to the wrong addresses. Basecoin outlines an algorithmic governance policy that utilizes a three-token approach to peg Basecoin to any asset or index such as USD or CPI in near-real-time. This occasion struck Bitcoin hard and the price fell by 40 percent. These altcoins use similar cryptographhy technology but employ different algorithmic designs. This solves the double-spending problem and does not require a trusted third party. In Februarythe exchange Mt. As a result, for the moment, media news sentiment is not a good proxy of investor sentiment for Tech Crunch Bitcoin Litecoin Workers Program cryptocurrency market. Each frequency bin encompasses a range of abnormal returns described by the two numbers adjacent to the bin. In the most recent studies on empirical finance, media news sentiment and overnight return are two popular measures of investor sentiment. Ethereum Classic, Golem, Augur, and Gnosis. Other Cryptocurrencies In addition to the aforementioned 10 cryptocurrencies, the following altcoins have also been drawing investor attention.

As the network effect weighs in, the prices of bitcoin and its variants have risen in tandem. This problem has remained unsolved for a long time, discouraging the prevalence of decentralized coins. In addition, the supply of different coins varies substantially due to the unique characteristics of each coin, and some coins are not mined, suggesting a fixed amount of supply. Other issues, such as security of safekeeping, reporting standard without custodian and trustee, and the governance structure of a decentralized and autonomous cryptocurrency system as well as the risk and complexity of dealing with unregulated identities, need to be assessed before a clearer picture can emerge. Exhibit 4 lists spanning tests on CRIX and the top 10 cryptocurrencies. When determining the market capitalization, circulating supply is used because it denotes the amount of coins circulating in the market and accessible to the public. As a result, for the moment, media news sentiment is not a good proxy of investor sentiment for the cryptocurrency market. Under such circumstances, the risk of cryptocurrency is not fully understood by investors, and the risk—return relation is not fully revealed by the market. At a global level, cryptocurrencies are appealing because they are resistant to censorship, government-mandated exchange rates, and local currency inflation. To answer the question of how quickly rational investors adjust this mispricing, we need to find a proxy of investor sentiment for individual cryptocurrencies. Meanwhile, in CRIX, Bitcoin seems to overwhelmingly dominate the other currencies as a result of the large market cap. The number of coins is mostly also included in the block explorer statistics. Nevertheless, currently, there are no prerequisites for devaluation. We agree with all investor sentiment stories documented in the stock market and build tests on investor sentiment hypothesis in the cryptocurrency market. Either the old economy framework is not suitable for a new and complex technology such as cryptocurrency, or immeasurable fundamentals are proxied by sentiments. Launched in , Factom is an open-source, distributed, and decentralized protocol built on top of Bitcoin. Investor Sentiment and Anomalies. Is Bitcoin Prepping for a Big Breakout? There are several systems by which miners can earn rewards through the mining process. Market capitalization, different categories of altcoins, and their features are summarized in Appendix A Ong et al. A specific challenge for the Cryptocurrency Market Index will be potential errors in data sources or other errors that may affect the weighting of constituents of the index. Thank you for your interest in spreading the word on The Journal of Alternative Investments.

To answer this question, we employ two types of mean—variance spanning tests. This is an estimate, however, because an uncertain Washington Post Bitcoin Article Best Ethereum Pool of coins are irretrievable in the network since users forget their private keys or send coins to the wrong addresses. Basecoin outlines an algorithmic governance policy that utilizes a three-token approach to peg Basecoin to any asset or index such as USD or CPI in near-real-time. This occasion struck Bitcoin hard and the price fell by 40 percent. These altcoins use similar cryptographhy technology but employ different algorithmic designs. This solves the double-spending problem and does not require a trusted third party. In Februarythe exchange Mt. As a result, for the moment, media news sentiment is not a good proxy of investor sentiment for Tech Crunch Bitcoin Litecoin Workers Program cryptocurrency market. Each frequency bin encompasses a range of abnormal returns described by the two numbers adjacent to the bin. In the most recent studies on empirical finance, media news sentiment and overnight return are two popular measures of investor sentiment. Ethereum Classic, Golem, Augur, and Gnosis. Other Cryptocurrencies In addition to the aforementioned 10 cryptocurrencies, the following altcoins have also been drawing investor attention.

As the network effect weighs in, the prices of bitcoin and its variants have risen in tandem. This problem has remained unsolved for a long time, discouraging the prevalence of decentralized coins. In addition, the supply of different coins varies substantially due to the unique characteristics of each coin, and some coins are not mined, suggesting a fixed amount of supply. Other issues, such as security of safekeeping, reporting standard without custodian and trustee, and the governance structure of a decentralized and autonomous cryptocurrency system as well as the risk and complexity of dealing with unregulated identities, need to be assessed before a clearer picture can emerge. Exhibit 4 lists spanning tests on CRIX and the top 10 cryptocurrencies. When determining the market capitalization, circulating supply is used because it denotes the amount of coins circulating in the market and accessible to the public. As a result, for the moment, media news sentiment is not a good proxy of investor sentiment for the cryptocurrency market. Under such circumstances, the risk of cryptocurrency is not fully understood by investors, and the risk—return relation is not fully revealed by the market. At a global level, cryptocurrencies are appealing because they are resistant to censorship, government-mandated exchange rates, and local currency inflation. To answer the question of how quickly rational investors adjust this mispricing, we need to find a proxy of investor sentiment for individual cryptocurrencies. Meanwhile, in CRIX, Bitcoin seems to overwhelmingly dominate the other currencies as a result of the large market cap. The number of coins is mostly also included in the block explorer statistics. Nevertheless, currently, there are no prerequisites for devaluation. We agree with all investor sentiment stories documented in the stock market and build tests on investor sentiment hypothesis in the cryptocurrency market. Either the old economy framework is not suitable for a new and complex technology such as cryptocurrency, or immeasurable fundamentals are proxied by sentiments. Launched in , Factom is an open-source, distributed, and decentralized protocol built on top of Bitcoin. Investor Sentiment and Anomalies. Is Bitcoin Prepping for a Big Breakout? There are several systems by which miners can earn rewards through the mining process. Market capitalization, different categories of altcoins, and their features are summarized in Appendix A Ong et al. A specific challenge for the Cryptocurrency Market Index will be potential errors in data sources or other errors that may affect the weighting of constituents of the index. Thank you for your interest in spreading the word on The Journal of Alternative Investments.

www.czechcrocs.cz Česká asociace pro chov a ochranu krokodýlů o. s.

www.czechcrocs.cz Česká asociace pro chov a ochranu krokodýlů o. s.